UBS said Monday that it believes an economic slowdown has started to take hold in the U.S. The firm argued that this will give the Federal Reserve the green light to lower rates.

“We expect an economic slowdown is underway. Fiscal support is fading. Many households are under pressure. Interest rates appear to be weighing on business activity,” the firm’s research team stated.

“A slowdown would signal monetary policy is more than sufficiently restrictive. As a result, the FOMC should pick up the pace dialing back restrictiveness in 2025,” UBS added, noting that it sees the Fed’s first rate cut coming in December.

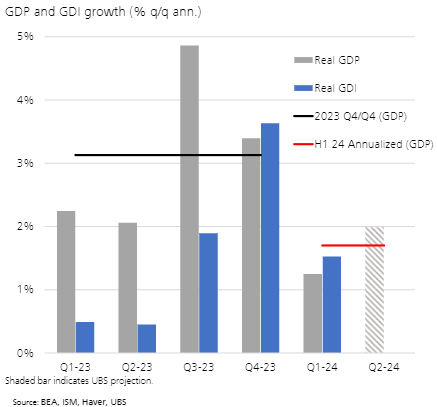

Moreover, the investment institution outlined that the annualized pace of growth in 2024 H2 is shaping up to be below 2%, which is noticeably lower than the 3.1% Q4/Q4 pace that was observed during 2023. See a chart UBS provided:

Dow, S&P, and Nasdaq tracking ETFs: (NYSEARCA:DIA), (DDM), (UDOW), (DOG), (DXD), (SDOW), (NYSEARCA:SPY), (VOO), (IVV), (SSO), (UPRO), (SH), (SDS), (SPXU), (NASDAQ:QQQ), (QLD), (TQQQ), (QID), and (SQQQ).