bunhill

Chip giant Nvidia (NVDA) continues to attract massive attention from investors, as the stock and its related options remained “firmly” at the top of Interactive Brokers’ (IBKR) weekly list of the most-active symbols on its trading platform.

Nvidia (NVDA) made history last week after it briefly became the world’s largest publicly listed firm, with a market capitalization north of $3.35T. The stock pulled back sharply soon after and suffered a more than 12% drop over the next three sessions, wiping out nearly $430B in market value.

“NVDA, NVDA, NVDA … That stock and its related options remain firmly at the top of the table,” IBKR’s chief strategist Steve Sosnick said in a weekly update on Tuesday.

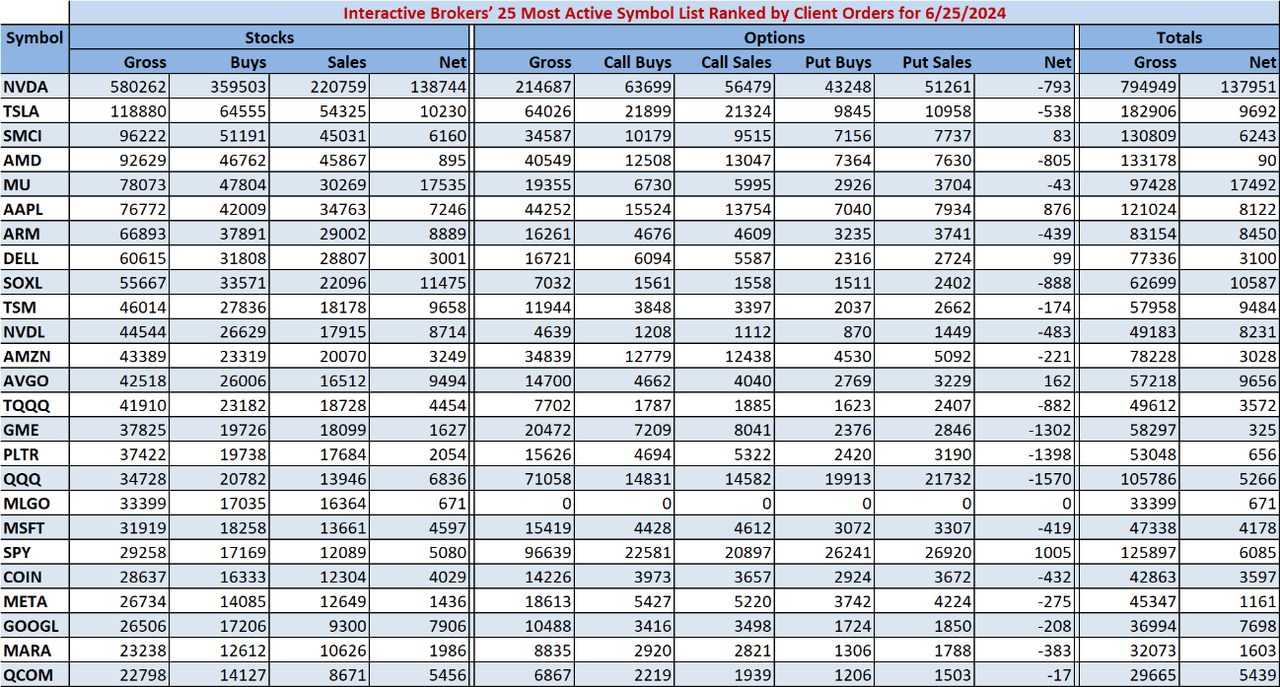

Nvidia (NVDA) saw gross trades of 794.9K across its stock and options on the IBKR platform over the prior five business days, and a positive net trade of 138K trades.

“Unfortunately, the net buying interest over the past 5 days has been strongly biased to the buy side. The options trading appears quite balanced, but a closer look shows a net long delta bias, with call buying and put selling outpacing the opposite strategies,” Sosnick added.

Notably, Nvidia (NVDA) on June 10 effected a 10:1 stock split. Its shares were trading above $1,200 before that. Splits can make buying a corporate stock more affordable to purchase for retail investors. Nvidia (NVDA) was last up 5.8% to $124.90.

Sosnick also highlighted how the GraniteShares 2x Long NVDA Daily ETF (NVDL) had climbed up the ranks on its list to 11th from 19th. The exchange-traded fund seeks twice the daily percentage change of Nvidia’s (NVDA) common stock.

“Interestingly, every stock on the list showed net buying activity. Note too that it is heavily biased toward large-cap tech stocks. AI-related semiconductor and equipment stocks appear near the top of the list – SMCI, AMD, MU, ARM, DELL, TSM, AVGO, SOXL – but the “usual suspects” are all well represented too (TSLA, AAPL, MSFT, META),” IBKR’s Sosnick said.

Nvidia’s (NVDA) three-day selloff that saw the stock enter correction territory on Monday also sparked broader market chatter about market participants starting to rotate out of megacap technology stocks into other sectors.

“This type of activity leads me to believe that the current pullback in tech stocks will see continued ‘buy-the-dip’ action, though it also raises the stakes about a more sustained correction in AI-related names metastasizing into a larger sell-off,” Sosnick added.

See below for the full data on the IBKR 25 most-active list: