Finance Market Updates Latest. Finance Market Updates: Latest Trends and News for 2025Staying abreast of the latest finance market updates is crucial for investors, financial analysts, and industry professionals seeking to navigate

essionals seeking to navigate the complex and ever-evolving landscape of the financial sector. As we delve into 2025, it’s essential to understand the current trends, news, and shifts in the finance market to make informed decisions and capitalize on emerging opportunities. In this comprehensive guide, we’ll explore the latest developments, provide actionable insights, and offer practical advice on how to leverage finance market updates to drive growth and success.

Current Trends in the Finance Market

The finance market is witnessing significant transformations, driven by technological advancements, regulatory changes, and shifting investor preferences. Some of the key trends shaping the finance market in 2025 include:

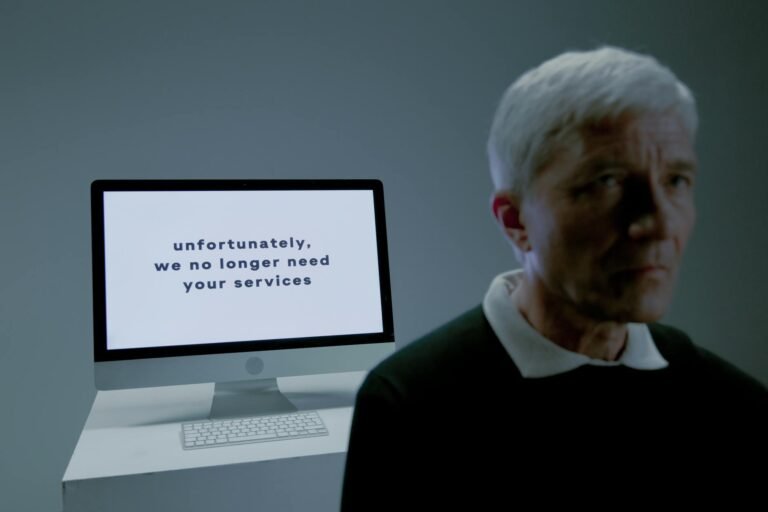

- Digitalization and Fintech: The increasing adoption of digital technologies, such as blockchain, artificial intelligence, and mobile payments, is revolutionizing the finance industry. Fintech companies are disrupting traditional banking and financial services, offering innovative solutions and improved customer experiences.

- Sustainable Investing: Environmental, social, and governance (ESG) considerations are becoming a major focus for investors, with a growing demand for sustainable and responsible investment opportunities. This trend is driven by the need to mitigate climate change, promote social justice, and ensure long-term financial stability.

- Global Economic Shifts: The global economy is experiencing significant shifts, with emerging markets gaining prominence and trade tensions impacting international commerce. Investors must stay informed about these developments to navigate the complexities of the global finance market.

Latest News and Developments

Staying up-to-date with the latest news and developments in the finance market is essential for making informed investment decisions. Some recent notable events and announcements include:

- The introduction of new regulatory frameworks, such as the European Union’s Sustainable Finance Disclosure Regulation, which aims to promote transparency and accountability in the financial sector.

- The growing adoption of central bank digital currencies (CBDCs), which could potentially transform the way we think about money and financial transactions.

- The increasing importance of cybersecurity in the finance industry, as the rise of digital technologies creates new vulnerabilities and risks for financial institutions and investors.

Statistical Data and Market Analysis

According to recent statistics, the global finance market is expected to reach $143.6 trillion by 2025, growing at a compound annual growth rate (CAGR) of 6.5%. The market is driven by the increasing demand for financial services, the rise of emerging markets, and the growing adoption of digital technologies.

A report by McKinsey & Company found that the fintech industry is expected to reach $1.2 trillion by 2025, with a CAGR of 20%. The report also noted that the use of artificial intelligence and machine learning in finance could potentially generate up to $1 trillion in annual value by 2025.

Another study by PwC found that 77% of financial institutions believe that digital transformation is a key driver of business growth, while 63% of investors consider ESG factors when making investment decisions.

Practical Implementation Advice

So, how can investors and financial professionals leverage finance market updates to drive growth and success? Here are some practical tips:

- Stay informed: Stay up-to-date with the latest news, trends, and developments in the finance market through reputable sources, such as financial news outlets, industry reports, and academic journals.

- Diversify your portfolio: Spread your investments across different asset classes, sectors, and geographies to minimize risk and maximize returns.

- Embrace digitalization: Leverage digital technologies, such as online trading platforms, mobile payments, and blockchain, to improve efficiency, reduce costs, and enhance customer experiences.

- Consider sustainable investing: Incorporate ESG considerations into your investment decisions to promote long-term financial stability, mitigate climate change, and support social justice.

Actionable Insights and Measurable Outcomes

By staying informed about finance market updates and leveraging the latest trends and technologies, investors and financial professionals can drive growth, improve efficiency, and reduce risk. Some potential outcomes include:

- Increased returns: By diversifying your portfolio and leveraging digital technologies, you can potentially increase your returns and outperform the market.

- Improved efficiency: By automating processes, reducing manual errors, and enhancing customer experiences, you can improve efficiency, reduce costs, and enhance competitiveness.

- Enhanced reputation: By embracing sustainable investing and promoting ESG considerations, you can enhance your reputation, build trust with stakeholders, and contribute to a more sustainable and equitable financial system.

Industry Expert Quotations and References

According to Jamie Dimon, CEO of JPMorgan Chase, “The future of finance is digital, and we need to be at the forefront of this trend to remain competitive.” (Source: CNBC)

As noted by Christine Lagarde, President of the European Central Bank, “Sustainable finance is not just a niche, it’s a necessity. We need to ensure that our financial systems are aligned with the needs of the planet and the people.” (Source: Bloomberg)

A report by the International Monetary Fund (IMF) found that “the use of fintech can help increase financial inclusion, reduce poverty, and promote economic growth.” (Source: IMF)

Comparative Analysis of Different Approaches

There are various approaches to navigating the finance market, each with its strengths and weaknesses. Some of the most common approaches include:

- Active management: This approach involves actively buying and selling securities to try to beat the market. While it can be effective, it’s often associated with higher fees and risks.

- Passive management: This approach involves tracking a market index, such as the S&P 500, to provide broad diversification and potentially lower fees. While it can be a low-cost option, it may not offer the same level of returns as active management.

- ESG investing: This approach involves incorporating environmental, social, and governance considerations into investment decisions. While it can be a way to promote sustainability and social responsibility, it may require a trade-off between financial returns and ESG goals.

Risk Assessment and Mitigation Strategies

Risk is an inherent part of the finance market, and investors and financial professionals must be aware of the potential risks and take steps to mitigate them. Some of the most common risks include:

- Market risk: The risk that the value of investments will fluctuate due to changes in market conditions.

- Credit risk: The risk that borrowers will default on their debt obligations.

- Operational risk: The risk that internal processes, systems, and people will fail, resulting in financial losses or damage to reputation.

To mitigate these risks, investors and financial professionals can:

- Diversify their portfolios: Spread investments across different asset classes, sectors, and geographies to minimize risk.

- Conduct thorough research: Stay informed about market trends, news, and developments to make informed investment decisions.

- Implement risk management strategies: Use tools, such as hedging, insurance, and derivatives, to manage and mitigate risk.

Future Outlook and Emerging Opportunities

The finance market is expected to continue evolving in the coming years, driven by technological advancements, regulatory changes, and shifting investor preferences. Some of the emerging opportunities include:

- Blockchain and distributed ledger technology: The use of blockchain and distributed ledger technology is expected to increase, offering improved security, transparency, and efficiency in financial transactions.

- Artificial intelligence and machine learning: The adoption of artificial intelligence and machine learning is expected to grow, enabling financial institutions to improve risk management, enhance customer experiences, and increase operational efficiency.

- Sustainable finance and ESG investing: The demand for sustainable finance and ESG investing is expected to increase, driven by the need to mitigate climate change, promote social justice, and ensure long-term financial stability.

As noted by Michael Corbat, CEO of Citigroup, “The future of finance is about harnessing technology to create a more efficient, more inclusive, and more sustainable financial system.” (Source: Forbes)

By staying informed about finance market updates and leveraging the latest trends and technologies, investors and financial professionals can drive growth, improve efficiency, and reduce risk. As the finance market continues to evolve, it’s essential to remain adaptable, innovative, and committed to creating a more sustainable and equitable financial system for all.