jetcityimage

Tesla (NASDAQ:TSLA) is expected to show a drop in quarterly deliveries when it issues its Q2 update during the first few days of July. The deliveries report will arrive just a few weeks ahead of the company’s full Q2 earnings report.

Analysts have been reeling in estimates on Tesla (TSLA) deliveries due to concerns over consumer demand, as well as registration data from Europe and China. Barclays cuts its forecast to 415,000 cars to have been delivered, which would mark an 11% year-over-year decline. RBC Capital Markets slashed its estimate to 410,000 vehicles after having a prior forecast just a few months ago for 533,000 deliveries in Q2. Meanwhile, UBS set its deliveries estimate at 420,000 units. For comparison, Tesla (TSLA) delivered 386,810 vehicles in Q1 and 466,140 vehicles a year ago in Q2. Tesla’s (TSLA) very highest deliveries tally in a quarter was Q4 of 2023, with 484,507 units delivered.

Some analysts think the Q2 deliveries report will be without the usual drama because the company has a high-profile Robotaxi event scheduled for later in the summer. “Compared to Q124 when investor attention was intensely focused on near-term delivery estimates being too high, we see a growing number of investors shifting their outlook to the Robotaxi event on August 8 and the opportunity related to FSD,” noted analyst Ben Kallo. He expects the investor focus to remain skewed towards the long term until the Robotaxi unveiling, which could include details on the low-cost, next-gen vehicle for the masses. Wedbush Securities analyst Dan Ives is also not expecting any major fireworks for the June quarter. Instead, he thinks the seeds for a demand turnaround are starting to take place, which means that it is now about execution for Musk and Tesla heading into the second half and beyond. For its part, UBS is more skeptical that the Robotaxi event will be an immediate share price catalyst. While the firm believes that Tesla (TSLA) is making good technological progress on the Robotaxi and Optimus initiatives and is more likely than most to capitalize off the manifestation of AI in the physical world, those developments are seen benefiting the financial model much further out. Elsewhere, Susquehanna thinks Tesla (TSLA) has several tailwinds turning in favor of its stock, which makes it a good time to buy long call options. The derivative strategists at the firm noted volatility in the stock has come down, seasonal trading patterns are looking positive, and shares have been underperforming most of the S&P 500. “Moreover, Tesla is a long-standing favorite among retail investors, further setting it up for gains as the frenzy for meme stocks returns to the markets,” highlighted Susquehanna’s Christopher Jacobson.

On Seeking Alpha, analysts continue to be more cautious than their Wall Street counterparts. For one, Dividend Sensei recently highlighted six reasons that TSLA’s robotaxi dreams will likely fail.

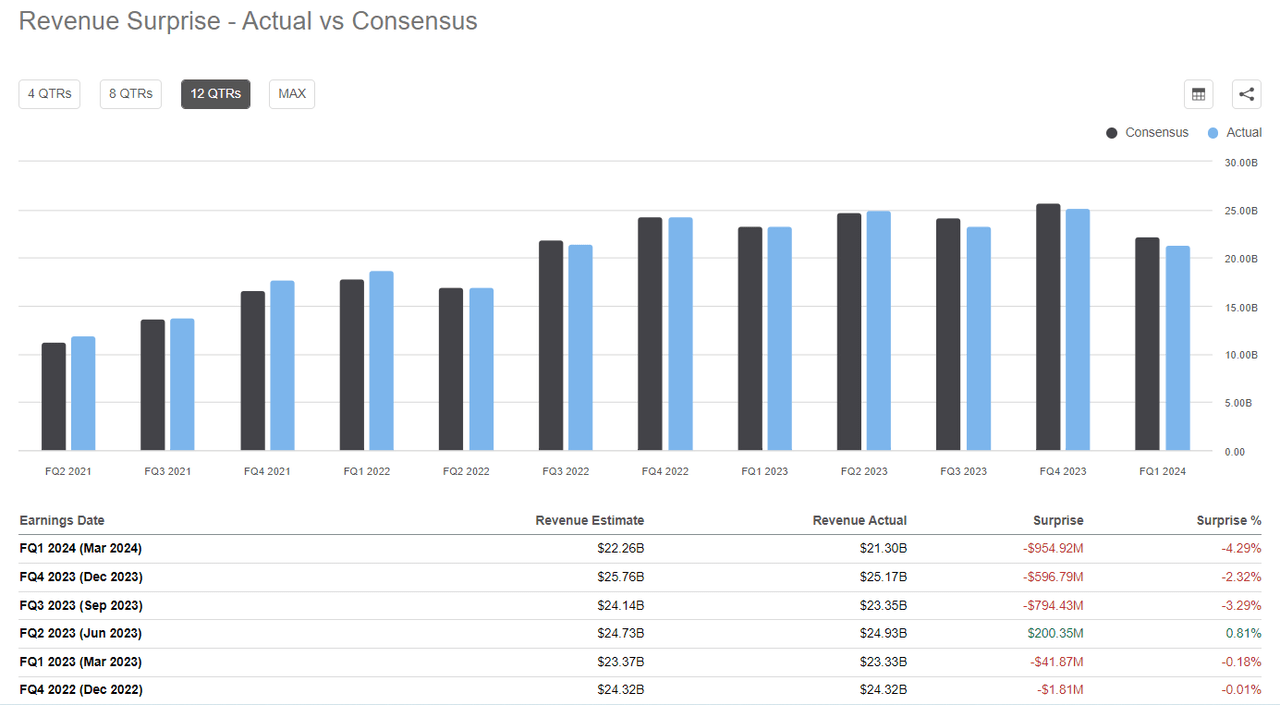

Before the big robotaxi event, the electric vehicle juggernaut will also have to report Q2 earnings. That report will throw another bright spotlight on the automotive gross margin line. Notably, Tesla (TSLA) has a recent track record of missing consensus quarterly estimates more times than beating them. Shares of TSLA have dropped in the week following earnings in three of the last four quarters.