The Utilities Select Sector SPDR Fund ETF (NYSEARCA:XLU), which tracks the utilities sector, rose about 5.6% in the second quarter of 2024, coming above the performance of the broader S&P 500 index, which increased 4.6% during the same period.

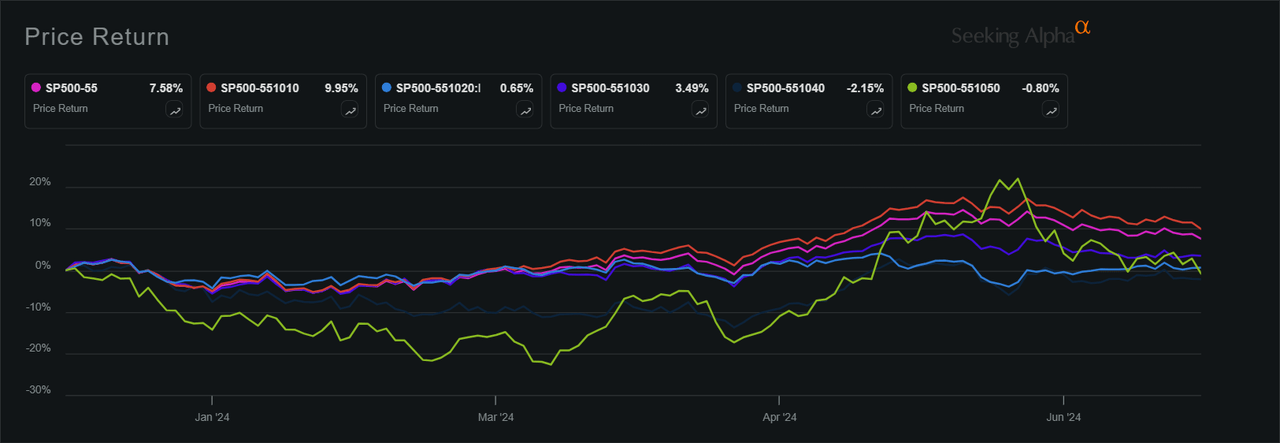

On a YTD basis, the ETF rose 8.8% while the utility index (SP500-55) had risen 7.6%, but still lagging behind the benchmark index’s rally of nearly 15%. XLE’s growth so far this year is the fourth highest compared to its ten other S&P sector peers.

Within the index, Electric Utilities (SP500-551010) surged 10%, Gas Utilities (SP500-551020) rose marginally to 0.65%, Multi-Utilities (SP500-551030) was up 3.49%, Water Utilities (SP500-551040) was down 2.2%, and Independent Power Producers (SP500-551050) fell 0.80% to date.

The fund, which has companies ranging from electricity providers to water suppliers, however, found itself at the bottom of the worst-performing S&P 500 sectors for the one-month period, down 3.62%.

XLU has $13.93 billion in assets under management as of June 28, 2024, and among its top three holdings are NextEra Energy (NEE), making up 14.15% of the fund, followed by Southern Company (SO) at 8.05% and Duke Energy (DUK) at 4.74%.

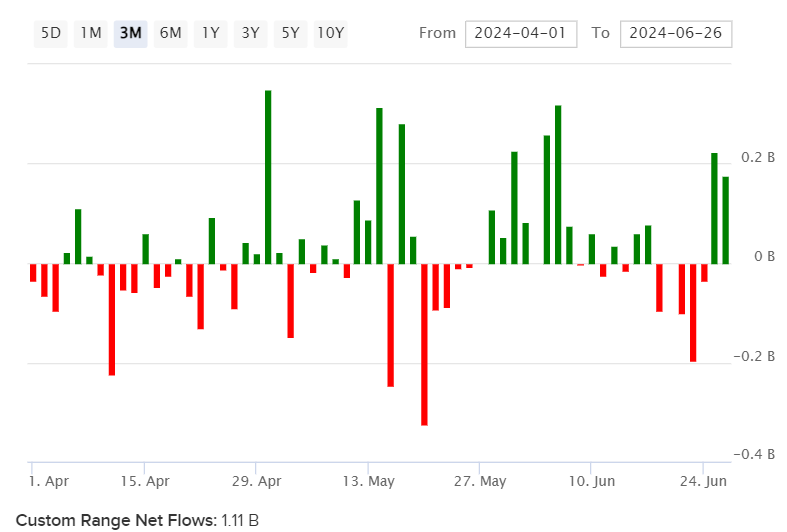

U.S. stock fund flows into and out of the utilities sector have been in the green for most weeks in the second quarter of 2023. The utilities-focused ETF has had a net inflow of $1.11 billion to date.

Image Source: etfdb.com

Top movers YTD

- Gainers: Vistra (VST) +123%

- Constellation Energy (CEG) +71%

- NRG Energy (NRG) +51%

- GE Vernova (GEV) +31%

- Public Service Enterprise Group (PEG) +21%

- Losers: Xcel Energy (XEL) -14%

- AES Corp (AES) -9%

- Eversource Energy (ES) -8%

- WEC Energy Group (WEC) -7%

- Exelon (EXC) -4%

What Quantitative Measures Say

XLU received a Hold rating from Seeking Alpha’s Quant Rating system with a score of 2.87 out of 5, supported by an A+ in liquidity and an A in the expenses category. The ETF got a C+ for momentum, an A+ for dividends, but a D for risks.

What Analysts Say

Seeking Alpha contributor High Yield Investor said in their May 22 report that “prominent leading institutional investors are pouring trillions of dollars into the utility sector in the face of severe short-term headwinds due to the very attractive long-term tailwinds for the sector. For retail investors who want to invest alongside them in pursuit of this thesis, XLU is arguably the best choice if passive and diversified exposure at a low cost is your priority.”

The author also noted that significant challenges remain for the utility sector, and the biggest of these is the higher-for-longer interest rate environment.

“Utilities are often viewed as bond proxies due to the regulated nature of their cash flows, which makes them generally quite stable and defensive through all economic environments. As a result, higher interest rates suppress utility stock prices during periods of elevated rates because markets require increased dividend and earnings yields from these bond-proxy stocks,” the author said.

Another SA contributor, Dane Bowler, writes that in the last few years, there have been two key changes to the investment prospects for utilities: 1. The valuation has gotten cheaper. 2. Fundamental growth has improved.

“With higher growth than normal and reasonable valuation, I think utilities have become attractive investments. While the sector as a whole looks opportunistic, certain individual stocks within are better positioned than others,” Bowler said in his analysis.