olddays

UBS assigned buy ratings to Royal Bank of Canada (RY)(RY:CA) and National Bank of Canada (NA:CA)(OTCPK:NTIOF) as it initiated coverage of Canadian banks, saying it’s “cautiously optimistic” about the Big Six group of lenders in the country.

Canada’s macro picture looks “challenging” with slow economic growth, rising unemployment and pressure on consumers even as the Bank of Canada last month cut its policy rate by 25 basis points to 4.75%, UBS said. But Canadian banks have solid balance sheets and capital positioning and a diversified business mix, UBS Analyst Jill Shea said in a note Tuesday.

“Amidst macro challenges and ahead of the mortgage renewal wave in Canada, we have an appreciation for the Big Six banks’ resilience of earnings through the cycle – the benefit of strong capital positions bolstered allowances, strong underwriting and the fundamental strength in place,” Shea said.

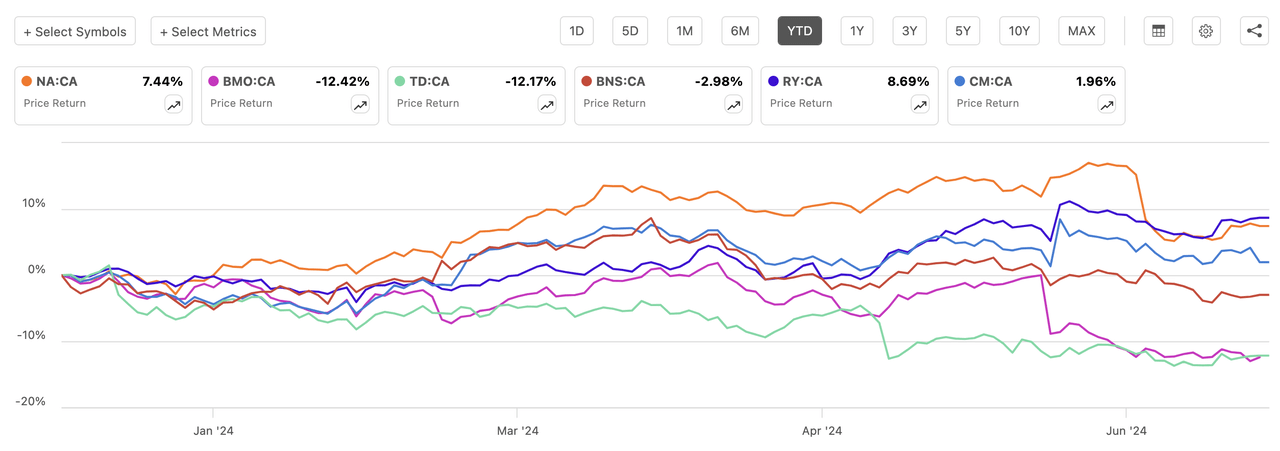

It assigned neutral ratings to Bank of Montreal (BMO), Bank of Nova Scotia (BNS) (BNS:CA), Canadian Imperial Bank of Commerce (CM)(CM:CA), and Toronto-Dominion Bank (TD:CA) (TD).

UBS with a C$165 ($120) price target on Royal Bank of Canada (RY)(RY:CA) sees 13% upside for the stock. “We favor the revenue diversification at Royal Bank and a bias to capital markets revenue exposure in a year with central banks easing and loan growth slowing,” Shea said. Also, RBC’s acquisition of HSBC Bank Canada this year presents meaningful expense savings, she said.

UBS also sees 13% upside for National Bank of Canada’s (NA:CA)(OTCPK:NTIOF) with its C$123 price target. “NA’s footprint as a super-regional Canadian lender concentrated largely in Quebec lends itself to relative resilience to housing-related issues.”

In Toronto trade, RBC (RY:CA)(RY) has gained +5% YTD and National Bank of Canada (NA:CA) has risen +7%. Toronto Stock Exchange’s S&P/TSX Composite Index (SPTSX) has risen +4% YTD, while the S&P 500 (SP500)(SPY)(IVV) has climbed nearly 15%.

ETFs focused on Canada include (EWC), (BBCA) and (FLCA).