sasacvetkovic33/E+ via Getty Images

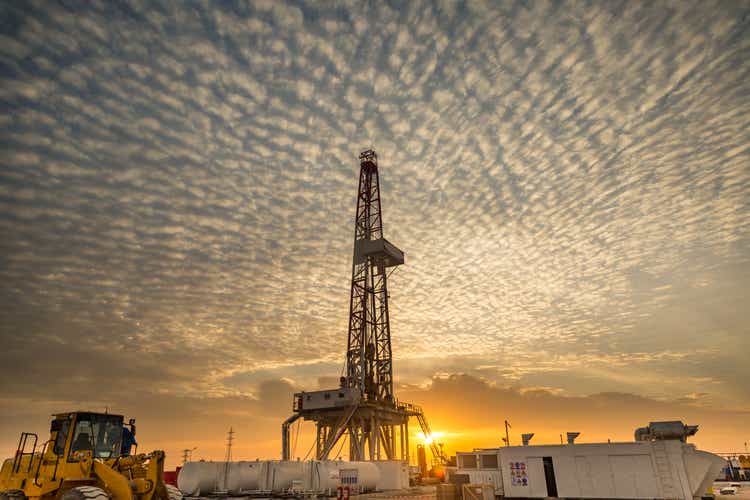

Permian Resources (NYSE:PR) +1.8% in Wednesday’s trading as BMO Capital upgraded shares to Outperform from Market Perform with a $21 price target, citing its increased Delaware footprint, plus strong operational and M&A track record, which should support continued organic and inorganic growth plus competitive capital returns.

BMO’s Phillip Jungwirth says Permian Resources (PR) has built a sizable position in west Texas’ Delaware Basin with more than 400K net acres and expected production of 310K-330K boe/day this year, a scale that has contributed to a top-tier cost structure and strong operational performance.

Synergy outperformance from the Earthstone acquisition has been impressive, with additional operating cost improvements possible, the analyst says.

Increased scale and basin-wide M&A activity have contributed to an improved multiple for Permian Resources (PR), Jungwirth says, while still seeing the stock’s valuation as “reasonable.”