TERADAT SANTIVIVUT

The Russell 2000 index (RTY) of small-cap stocks climbed more than 3% during Thursday’s session while large-cap equities slumped – a rare move for investors to see, according to Bespoke Investment Group.

The Russell 2000 (RTY)(IWM) rose as much as 3.6% during the day, with expectations for a September rate cut by the Federal Reserve fired up after government data showed inflation continued to cool down in June. The S&P 500 (SP500)(IVV), meanwhile, was losing 0.9%.

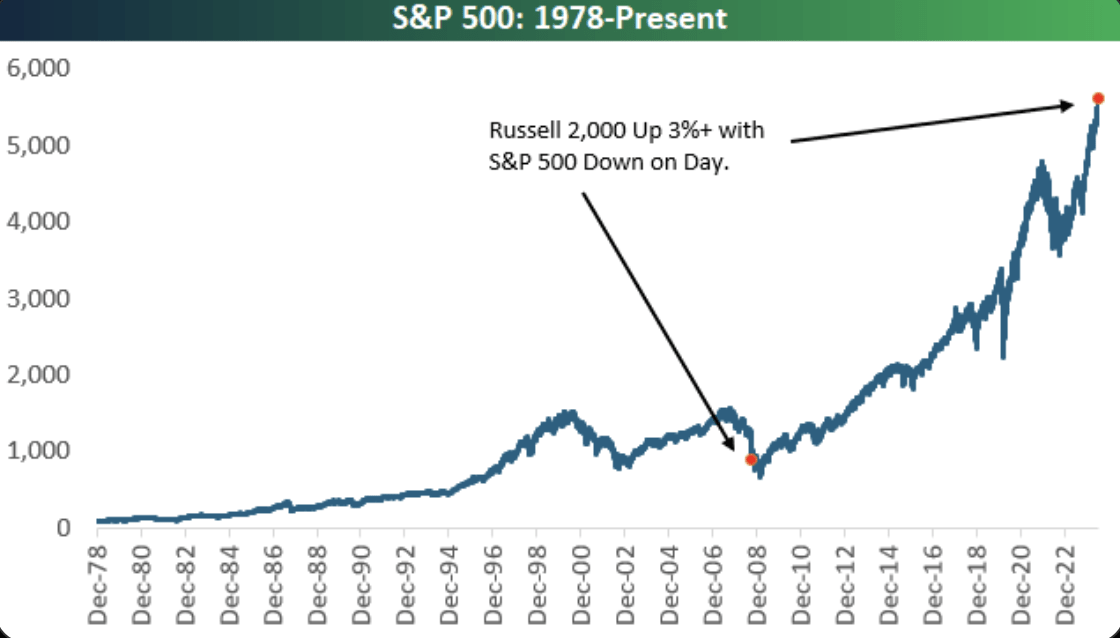

“There’s been just one other trading day since 1979 when the small-cap Russell 2,000 rose 3%+ while the S&P 500 was down on the day,” Bespoke said in a post on X (formerly Twitter).

That trading day was October 10, 2008, when the Russell 2000 (RTY) gained 4.6% while the S&P 500 (SP500)(VOO) fell 1.2%. Here’s Bespoke’s chart:

The small-caps gauge has lagged the S&P 500 (SP500) this year. Investors have been concerned about small businesses being hurt by the Fed’s higher-for-longer stance on interest rates because of sticky inflation. Business filings for bankruptcies climbed 40% over the past year through March, according to the Administrative Office of the U.S. Courts.

The S&P 500 (SP500) struggled on Thursday with the “Magnificent 7” stocks, including Nvidia (NVDA), falling. Tesla (TSLA), which has been rallying over the past six weeks, dropped after Bloomberg reported the EV maker may be delaying its robotaxi event until October. Earnings concerns for Delta (DAL) and PepsiCo (PEP) also weighed on the index.

The Russell 2000 (RTY) has risen +4% so far this year, compared with the 17% leap for the S&P 500 (SP500).

ETFs tracking those indexes include (RSP), (SPXU), (IJR), (VBR), and (SCHA).