da-kuk/E+ via Getty Images

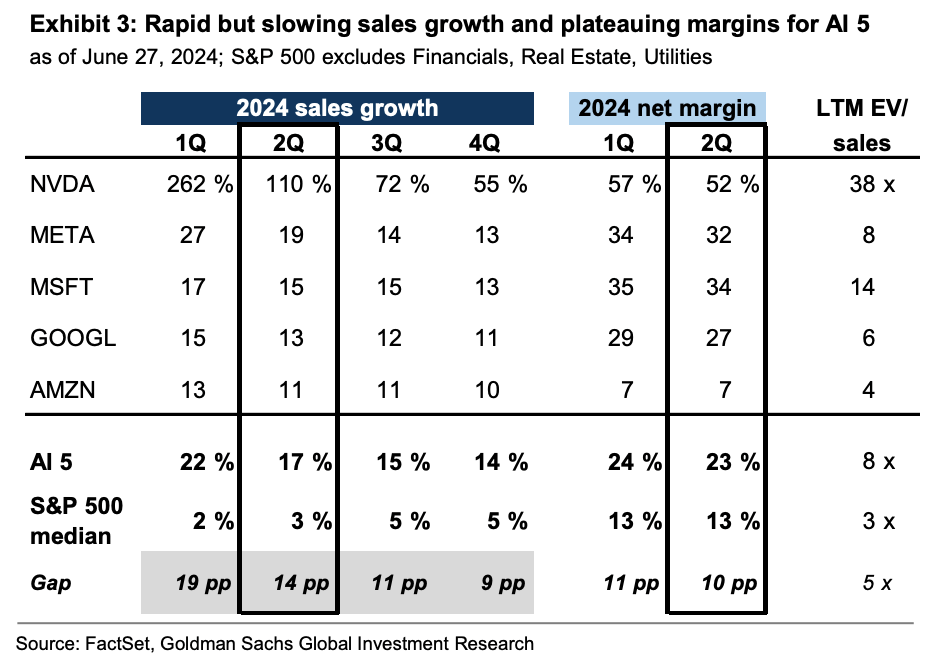

Sales growth for AI-related megacap stocks is expected to have cooled in Q2 and continue that trend through the end of the year.

According to consensus forecasts, Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) will see a slowdown in sales growth, while every one but Amazon will see a decline in net margins.

“Sales growth for the five stocks is forecast to slow from 22% year/year in 1Q to 17% in 2Q, and further to 15% in 3Q and 14% in 4Q,” Goldman Sachs equity strategist David Kostin said. “NVDA sales growth is expected to slow from 262% year/year in 1Q to 110% in 2Q, 72% in 3Q, and 55% in 4Q.”

“In contrast, sales growth for the median S&P 500 (SPY) (IVV) (VOO) stock will be accelerating, albeit from a slower rate (year/year growth of 2%, 3%, 5% and 5%, respectively).”

“Despite the expected deceleration in mega-cap tech profit growth, the stocks’ valuations generally remain high,” Kostin added. “Although the expected slowdown in sales growth sets a low bar for the group’s results, EV/sales valuation multiples have increased by 28% YTD.”

“If consensus estimates are realized, the 2Q reporting season will be an important test of whether investors are willing to pay the same valuation premium for the group while the EPS growth differential between the mega-caps and the rest of the market is forecast to narrow significantly in 2H 2024 and 2025,” he said.

“The five mega-cap tech stocks trade at 8x EV/sales, compared with 3x for the median S&P 500 stock.”

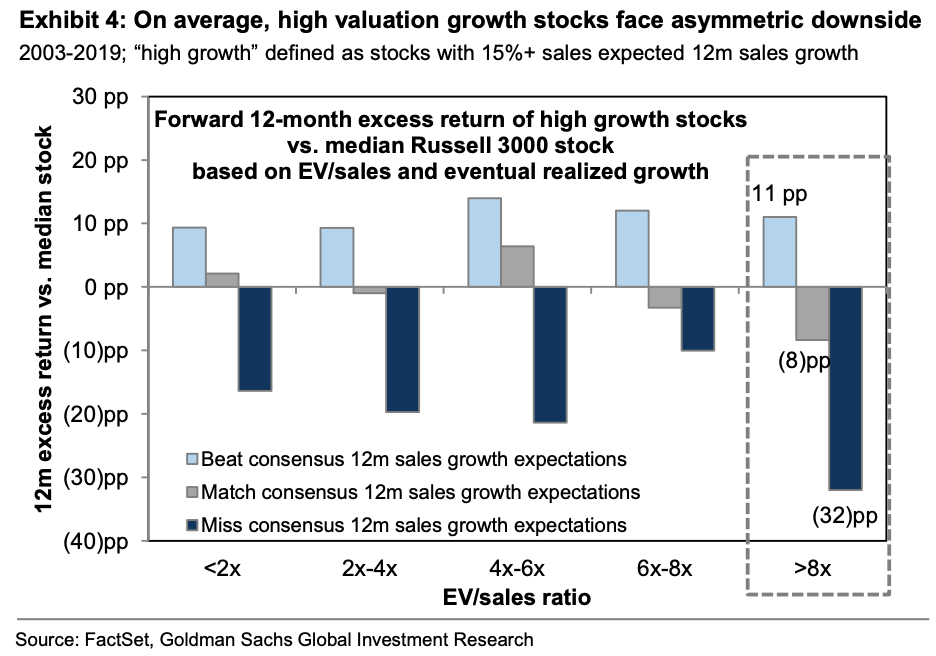

“History shows that growth stocks with high valuations face asymmetric downside risk from failing to meet consensus expectations,” Kostin said. “During the past 15 years, roughly an equal share of growth stocks went on to beat and miss consensus forward 12-month revenue growth forecasts.”

“The stocks beating forecasts outperformed peers by a median of 10 pp during the concurrent 12-month period, while firms missing estimates lagged by a median of 18 pp,” he said. “The distribution of outcomes was especially unfavorable for firms with high valuations.”

“Companies trading above 8x EV/sales generated nearly the same reward as low multiple stocks when beating estimates but lagged the median Russell 3000 (IWV) stock by 32 pp when they missed sales estimates, almost double the typical underperformance of lower multiple stocks.”