Thitima Uthaiburom/iStock via Getty Images

Individual investors have been moving more capital into chip stocks, in particular Nvidia (NASDAQ:NVDA) and levered tech exchange-traded funds, but an overall lull in purchases of stocks and ETFs by that cohort has continued through Q2, according to Vanda Research.

Vanda in a mid-week note said it’s seeing retail traders pushing greater amounts of capital toward semiconductor stocks, mainly AI chip behemoth Nvidia (NVDA) and the Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL). “When it comes to leverage, hard flow retail data suggest that appetite for levered ETF products remains high,” with purchases of levered long ETFs “unabated,” said Marco Iachini, senior vice president of research at Vanda.

Net retail purchases of levered single stock ETFs rose to +$579M in early June, its data showed. Many market professionals consider levered products riskier than others. Individual investors are also chasing levered long bets on Nvidia (NVDA) through GraniteShares 2x Long NVDA Daily ETF (NVDL).

“This ETF has now reached >US$4bn in market cap – i.e., roughly a third of SOXL’s size – in just over six months,” Iachini said. “It also looks like crowding in this space has attracted the attention of short sellers,” he said.

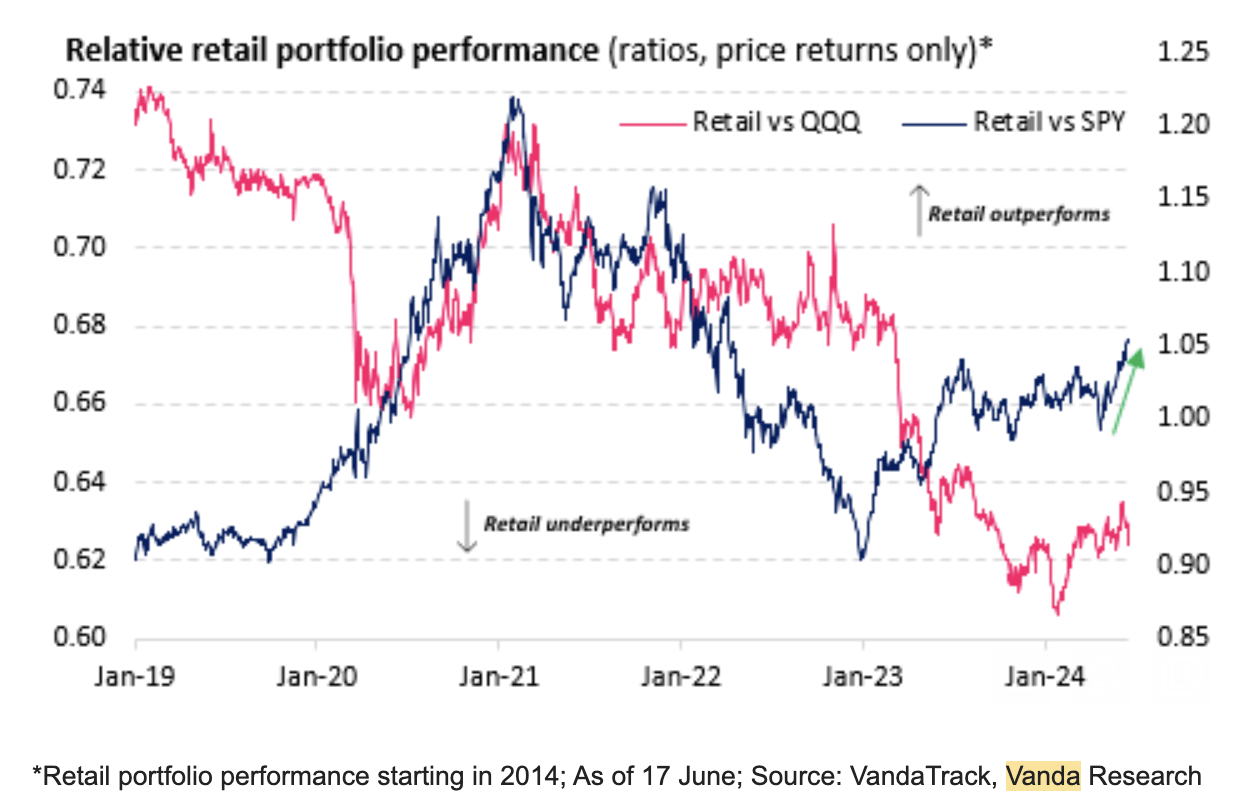

Retail investors’ market exposure has been narrowing around mega-cap tech stocks (QQQ)(XLK). But that focus appears to be paying off as those investors are beating the S&P 500 (SP500) (SPY) so far this year, Vanda said. Beating the Invesco QQQ Trust ETF (QQQ) has been tougher. Here’s a chart:

“[Unless] other quintessential retail favorite niches – be it small caps, crypto, or meme stocks – start outperforming in a more durable way, we wouldn’t be surprised to see retail continue to pile into this group of large-cap tech stocks,” Iachini said. Nvidia (NVDA) has gained ~156% this year, GraniteShares 2x Long NVDA Daily ETF (NVDL) has soared +398%, and (SOXL) has advanced +85%.

Overall, aggregate net purchases of stocks and ETFs are atypically weak for this time of the year, and “subdued” purchasing activity by retail investors has become puzzling lately, Vanda said. Daily net purchases of U.S.-listed securities recently failed to rise above the $1B threshold for 45 consecutive trading days, the longest streak of the post-pandemic era, Vanda said. Its VandaTrack tool monitors retail flow in +9K securities in the U.S.