Nikada

The second-quarter earnings season will shift into higher gear Friday with some major banks releasing results, and shares of most of a group of big banks have outstripped the S&P 500’s (SP500) advance this year.

JPMorgan Chase (JPM) and Wells Fargo (WF) will be among those kicking off the parade of Q2 bank results. Broadly for banks, analysts say among the figures to watch are those for loan growth, which are likely to remain soft in the face of still-high interest rates.

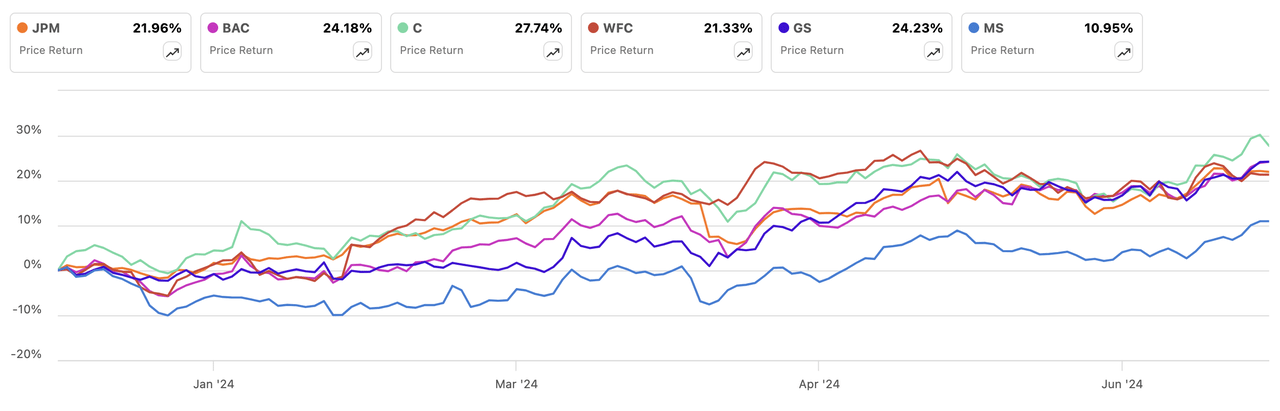

But prospects for the Federal Reserve to begin lowering borrowing costs in 2024 has helped drive up the S&P 500 Banks index (SP500-401010) by 19% this year. Shares of five of six big banks, whose results are in Wall Street’s spotlight, have moved higher than the Banks index and the 17% advance in the S&P 500 (SP500)(SPY)(VOO) in 2024.

Here’s how shares of six major banks have performed YTD ahead of Q2 results:

- Citigroup (C) – up 27.7%. Market cap: $127.8B

- Goldman Sachs (GS) – up 24.2%. Market cap: $162.7B

- Bank of America (BAC) – up 24%. Market cap: $326.4B

- JPMorgan & Chase (JPM) – up 21.9%. Market cap: $596.7B

- Wells Fargo (WFC) – up 21.3%. Market cap: $208.2B

- Morgan Stanley (MS) – up 11%. Market cap: $168.1B

ETFs tracking big lenders and regional banks include (KBWB), (KBE), (IAT), and (DPST).