ArLawKa AungTun/iStock via Getty Images

Large real estate stocks kicked off the second half of 2024 with a marginal weekly loss despite the optimism surrounding rate cuts, as the state of the sector weighed on sentiment.

S&P 500 advanced 1.95% from last week, with the labor market data supporting the case for Federal Reserve interest rate cuts. The probability of a 25 basis points rate cut in September now stands at 72.0%, compared to 47.0% at June-beginning, the CME FedWatch Tool showed.

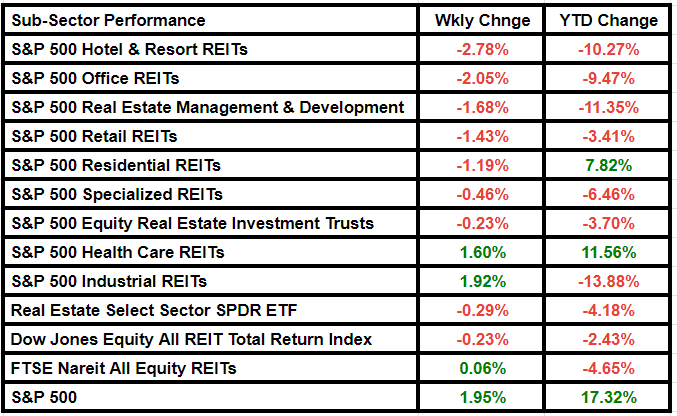

REITs benefitted from the reduced investor pessimism. The FTSE Nareit All Equity REITs index, constituting all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets, gained 0.06% on a weekly basis.

However, the Real Estate Select Sector SPDR ETF and the Dow Jones Equity All REIT Total Return Index declined by 0.29% and 0.23%, respectively.

Much of the commercial real estate sector continues to deteriorate, with rising delinquency rates on debt and falling property values. Things are likely to get substantially worse before they get better, Seeking Alpha analyst Bret Jensen said in a recent research report.

CRE market continues to face challenges from elevated interest rates and rising supply, while the housing market is short of supply.

Citi downgraded home builders Lennar (LEN) and D.R. Horton (DHI) to Neutral from Buy on softening housing activity this summer.

Home furnishings retailer RH (RH) acknowledged what has been “the most challenging housing market in three decade” and cautioned that “the constantly changing outlook regarding monetary policy will continue to weigh on the housing market through the second half of 2024 and possibly into 2025.”

Mortgage applications dropped this week as rates bounced back up.

The first presidential debate of the 2024 election cycle between President Joe Biden and former President Donald Trump saw Biden promising reduced housing prices and more stock. But the topic of housing came up just twice in the debate, implying that housing would not likely be a focal point, Realtor.com said in an article, citing economist Ralph McLaughlin.

“There are still far too many households experiencing housing insecurity and distress in this country and far too little national discussion about it,” said McLaughlin.

XLRE saw net outflows worth $161.31M this week, compared to inflows worth $213.57M last week, data from the information solutions provider VettaFi showed.

Seeking Alpha’s Quant Rating system changed its recommendation on the ETF to Sell from Hold, while SA analysts rate the fund as Buy. Meanwhile, Citi Research says the S&P 500 has more upside to go, and spotlighted real estate as a sector it holds an overweight stance on.

SBA Communications (SBAC), Host Hotels & Resorts (HST), Weyerhaeuser (WY), Simon Property Group (SPG) and VICI Properties (VICI) were the major S&P 500 real estate losers of the week. Alset (AEI), Logistic Properties of the Americas (LPA) and La Rosa Holdings (LRHC) were the other notable sector losers.

Here is a look at the subsector performance for the week: