MicroStockHub/E+ via Getty Images

Bitcoin (BTC-USD) is set to fall 5.2% on a weekly basis, as the robust demand buoyed by the creation of spot BTC ETFs earlier in the year has cooled.

“Bitcoin is facing some short-term headwinds as the market fears sell pressure from governments and Mt. Gox distributing Bitcoin to creditors, but these are likely overblown and temporary. This is a unique opportunity for long-term investors,” said Cory Klippsten, CEO of Swan, a Bitcoin financial services firm.

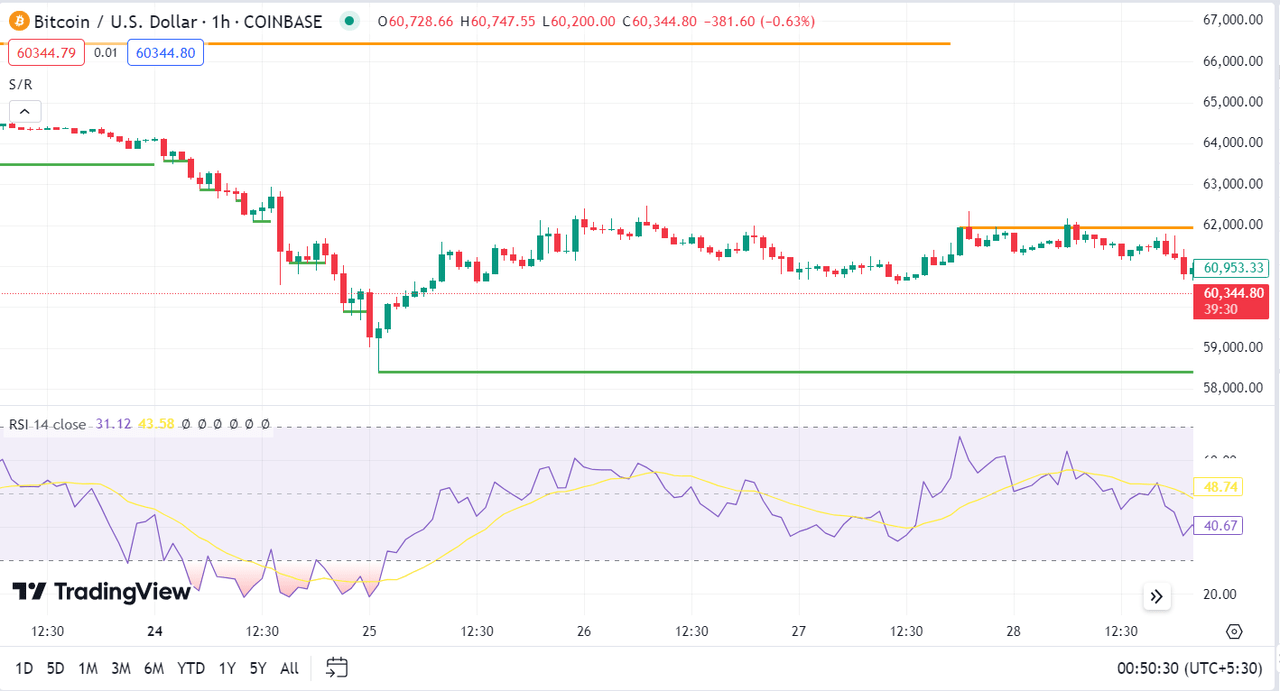

The oldest cryptocurrency started off the week on a subdued note, as it dropped below the $60K mark on Monday. BTC, however, climbed back to the mark from Tuesday and since then has stuck to the narrow trading range of $60.6K-$62.1K.

The slump on Monday came after an index of the largest 100 digital assets dropped 5% in the week through Sunday, its biggest loss since April.

“The meme coin market has experienced a general pullback this month as Bitcoin prices face pressure,” said Lucy Hu, Senior Analyst, Metalpha.

The expectation of one rate cut by the Federal Reserve has prompted investors to divert from risky assets to less risky ones, Hu added.

BTC has been seeing a gradual slump in its prices since the start of this month. The cryptocurrency has been down 9% since the start of June.

BTC was not largely impacted by the in-line May’s personal consumption expenditures price index. Both the headline and core PCE inflation eased in May, as expected.

“Bitcoin’s relative volatility rankings had higher peaks compared to the crash triggered by COVID-19 but similar ranges for the most part,” SA analyst CFA Institute Contributors said.

With mainstream adoption of Bitcoin increasing alongside further regulations, the perception of its volatility will continue to evolve, CFA Institute Contributors added.

Notable News

- Bitcoin (BTC-USD) bull Peter Thiel said BTC is likely not going up much from here.

- Coinbase Global (COIN) said it has partnered with the financial services and software as a service company Stripe (STRIP).

- Block’s (SQ) commitment to Bitcoin (BTC-USD) reflects a strategic vision for future gains, Chief Financial Officer and Chief Operating Officer Amrita Ahuja said in an interview.

- Marathon (MARA) has started mining Kaspa (KAS-USD), a proof-of-work digital asset, to further diversify its portfolio of digital asset compute.

- Robinhood Markets (HOOD) was upgraded by Wolfe Research to Outperform from Peer Perform after meeting with HOOD Chief Financial Officer Jason Warnick.

- The Ontario Securities Commission Tribunal will hold a hearing on Thursday to consider Riot Platforms’ (RIOT) application seeking interim and/or permanent cease trade orders regarding Bitfarms’ (BITF) shareholder rights plan.

- U.S. Securities and Exchange Chairman Gary Gensler said on Tuesday the approval process for Ether (ETH-USD) spot exchange-traded funds is going “smoothly,” but the timeline remains uncertain.

- Exchange-traded fund investing directly in Ether (ETH-USD), once cleared for trading, will likely attract slower demand than spot Bitcoin (BTC-USD) ETFs, Bernstein said.

Bitcoin, Ether prices

Bitcoin (BTC-USD) was down 2% to $60.3K at 3:22 pm on Friday, and Ether (ETH-USD) fell ~2% to $3.4K.