sell tech business is transforming the industry. The question isn’t *if* you’ll sell your tech business-it’s *when* you’ll realize you’re not built to run it forever. I’ve watched founders wake up at 3 a.m. staring at a screen full of red margins, asking themselves the same question: *Is this the grind or the golden ticket?* The difference between burning out and building wealth often comes down to timing-not just when you list it, but when you *stop* treating it like your only legacy. That’s the moment you need to know how to sell your tech business right.

sell tech business: The valuation isn’t the story

Most founders fixate on the number-what a buyer will throw on the table-but that’s the easy part. I helped a client sell their carbon sequestration tech to an energy giant for 4x EBITDA, not because their tech was flashy, but because they had two things buyers crave: a locked-in customer contract with a government agency and a team that could scale without the founder. The buyer didn’t care about the codebase’s age; they cared about how fast they could turn a profit with it. In other words, the valuation wasn’t a number-it was a promise of what you’d leave behind.

Buyers want more than code

Here’s the brutal truth: you can’t just slap a “Built in Python” sticker on your door and call it a day. The best deals close when sellers understand buyers actually want three things simultaneously. Researchers at MIT found that businesses with organic growth over 18 months command premiums of 15-20% over stagnant ones. That’s because buyers don’t want your hobby-they want:

- Recurring revenue-not one-off pilots. One client sold their SaaS for 30% less than market because their “recurring revenue” was just monthly retainers from a single client.

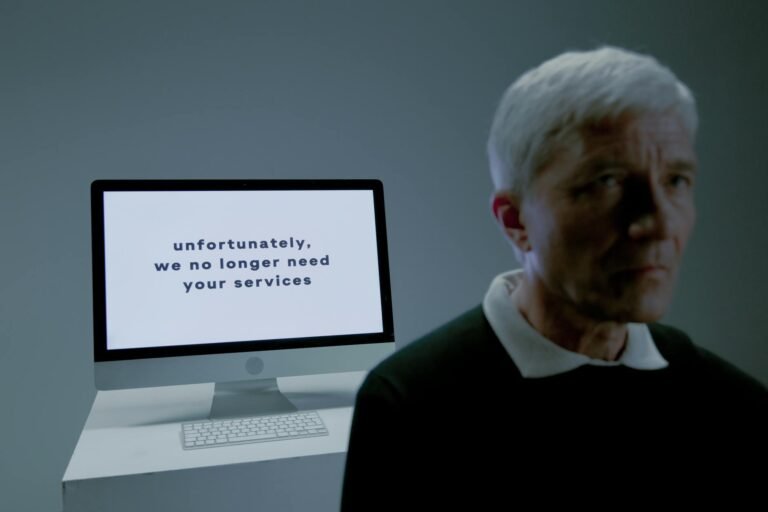

- A team that sticks-buyers hate hiring. A founder once told me, “My entire engineering team signed NDAs the day before closing.” The buyer laughed and walked.

- Scalability without you-if the business halts when you take a vacation, it’s a lemon. The best sellers document everything-from onboarding scripts to customer pain points.

Timing matters more than markets

I’ve seen founders wait for “perfect” conditions-only to watch their valuation gap widen by 30% while they obsess over timing. One cybersecurity client waited for a boom market, but by the time it arrived, their bookkeeping looked like a teenager’s expense tracker. They sold in a slower market anyway-and got more than they would’ve waited for-because they’d spent a year cleaning their financials. Preparation isn’t waiting for the right time; it’s making sure the time *finds you ready*.

Start now: treat your business like a franchise, not a side hustle. Document your processes. Separate your personal finances from the company’s. And for heaven’s sake, stop using your personal credit card for “business expenses”. One client had to manually categorize 18 months of transactions to prove their EBITDA-because their “tech business” was just their basement with a server.

Who’s actually buying?

Not all buyers are created equal. Strategic acquirers-companies in your niche-will pay premiums because they see immediate synergy. Financial buyers, like private equity, care about cash flow and leverage, not your founding story. Individual acquirers might move fast but lack resources. The key? Know your buyer type and tailor your sale to their needs.

Take the AI legal research tool I helped sell. Instead of pitching to “any law firm,” we focused on firms with 500+ attorneys. Why? They had deep pockets and a clear pain point: inefficiency. When we gave them custom ROI projections-not just “this is cool”-three firms competed for it. They ended up paying 25% more than our asking price. The lesson? Buyers buy solutions to problems, not products.

Selling your tech business isn’t about the tech-it’s about turning what you’ve built into a story someone else can’t resist. The best exits happen when you stop thinking like a founder and start thinking like a storyteller. Because at the end of the day, the business you sell isn’t just an asset-it’s your legacy. And the right buyer will see that too.