Jonathan Knowles

Coca-Cola Company (NYSE:KO) traded 1.4% higher on Monday after BNP Paribas Exane initiated coverage on the beverage stock with an Outperform rating and named it a top sector pick.

Analyst Kevin Grundy pointed to a compelling valuation on Coca-Cola (KO), even factoring in the likelihood of an unfavorable legal outcome in the IRS case. “KO is a best-in-class CPG co. that has not been a best-in-class stock. We think that will change given market share momentum, much-improved EPS delivery, an enhanced financial profile, and an emerging return of capital story,” noted Grundy. Crucially, Coca-Cola (KO) is seen having massive growth potential outside the U.S. In addition, Grundy and his team think margins and EBITDA can improve if Coca-Cola (KO) finalizes refranchising of its owned bottling assets

As for the IRS case, BNP Paribas Exane thinks a $16.5 billion cash settlement and 3.5% increase to KO’s effective tax rate moving forward is already being priced in by investors.

Meanwhile, BNP Paribas has a more cautious view on PepsiCo (PEP). “While PEP remains a high-quality staples stock, sluggish N. America volumes in the company’s flagship market (65% of profits) and protracted US market share issues (particularly in beverages) are concerning,” warned Grundy. The firm started off coverage on PepsiCo (PEP) with a Neutral rating.

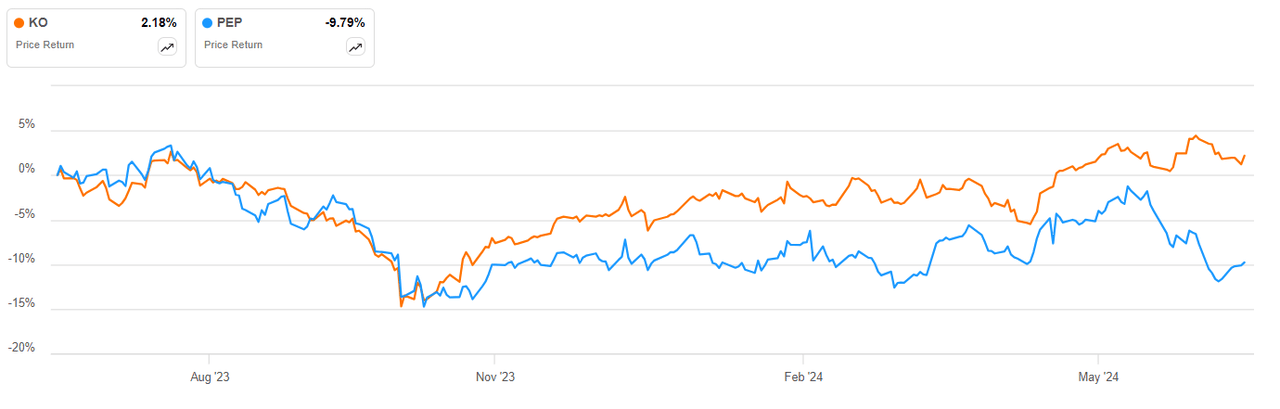

Shares of Coca-Cola (KO) have outperformed PepsiCo (PEP) over the last year by a wide margin, due in part to better sales numbers in the U.S., per Nielsen data.

On Wall Street in general, analysts have a preference for Coca-Cola (KO) over PepsiCo (PEP). While both stocks have Seeking Alpha Quant Ratings of Strong Buy, Coca-Cola (KO) has the higher overall quant score.