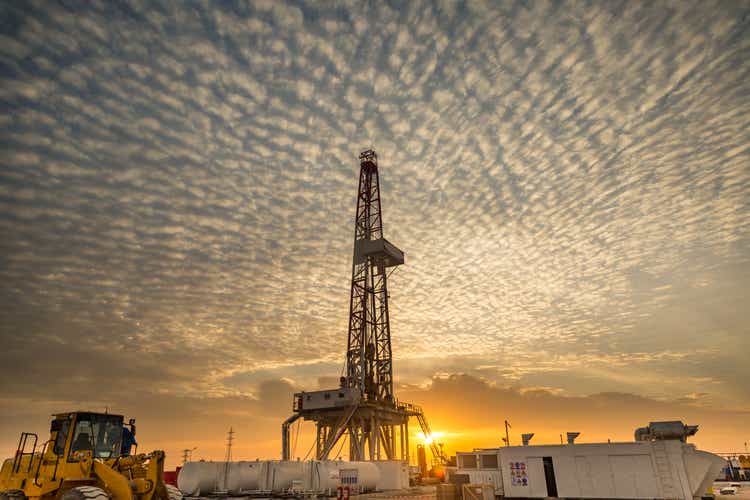

sasacvetkovic33/E+ via Getty Images

Crescent Energy (NYSE:CRGY) +1.4% in Thursday’s trading as KeyBanc launches coverage with an Overweight rating and $16 price target, pointing to the pending $2.1B SilverBow acquisition which increases scale and production in the Eagle Ford shale and has clear synergies that can be attained both financially and operationally.

Crescent Energy (CRGY) looks significantly undervalued, KeyBanc’s Tim Rezvan writes, particularly on the basis of free cash flow yield, which the analyst forecasts at 16.3% in FY 2025, ranking among the best of any E&P company under the bank’s coverage.

Rezvan says his bullish thesis is supported by an increasingly clean ownership structure; in Crescent’s (CRGY) dual-class share structure, the company’s publicly traded Class A shares have increased from 25% of total shares in 2021 to 53% currently and should further increase to 72% post-closing, while the overhang from Class B shares has faded significantly.