Vertigo3d

“It’s an uptrend if you participate, it’s a bubble if your neighbor participates.”

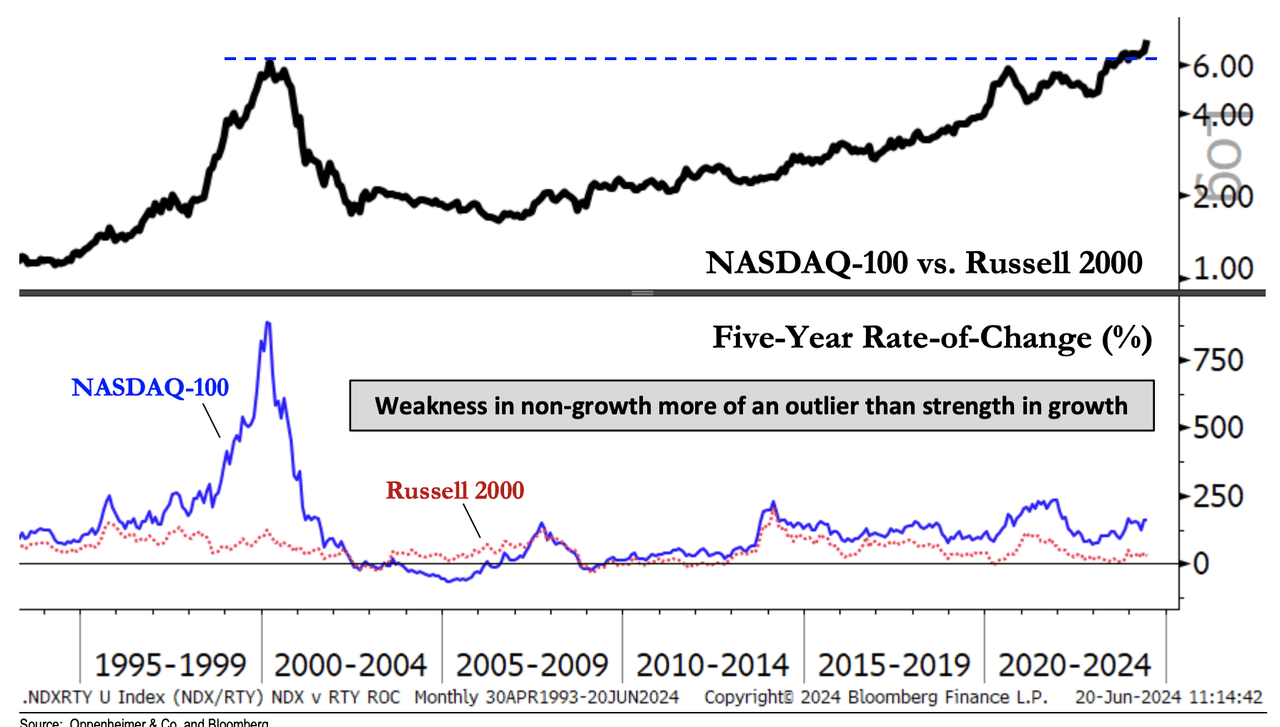

That’s the old adage Oppenheimer technical analyst Ari Wald referenced when looking at whether the Nasdaq 100 (NASDAQ:QQQ) is in bubble territory. But he noted that rather than growth being overvalued currently, it’s non-growth that is historically lagging and when the gap does narrow it may be non-growth rallying as the driver rather than a collapse in growth prices.

“We still agree that market bifurcation, and specifically, the spread between growth and non-growth, is perhaps as wide as it’s been since the 1990s,” Wald wrote in a note. “Our differentiated take remains that the driver of this spread has been weakness in non-growth more than it’s been strength in growth.”

“Consider the NASDAQ-100 and Russell 2000 (NYSEARCA:IWM) as proxies for this relationship,” he said. “While the ratio has broken through its year-2000 peak, the five-year rate-of-change for the individual parts shows a significant discrepancy between now and then.”

“The outlier, from our vantage point, is that the Russell is coming off a single-digit reading (5%, Q4’23) that has been more consistent with major market lows than market tops. This is why we believe convergence is more likely to be catalyzed by catch-up over the coming years.”

‘Untapped firepower’

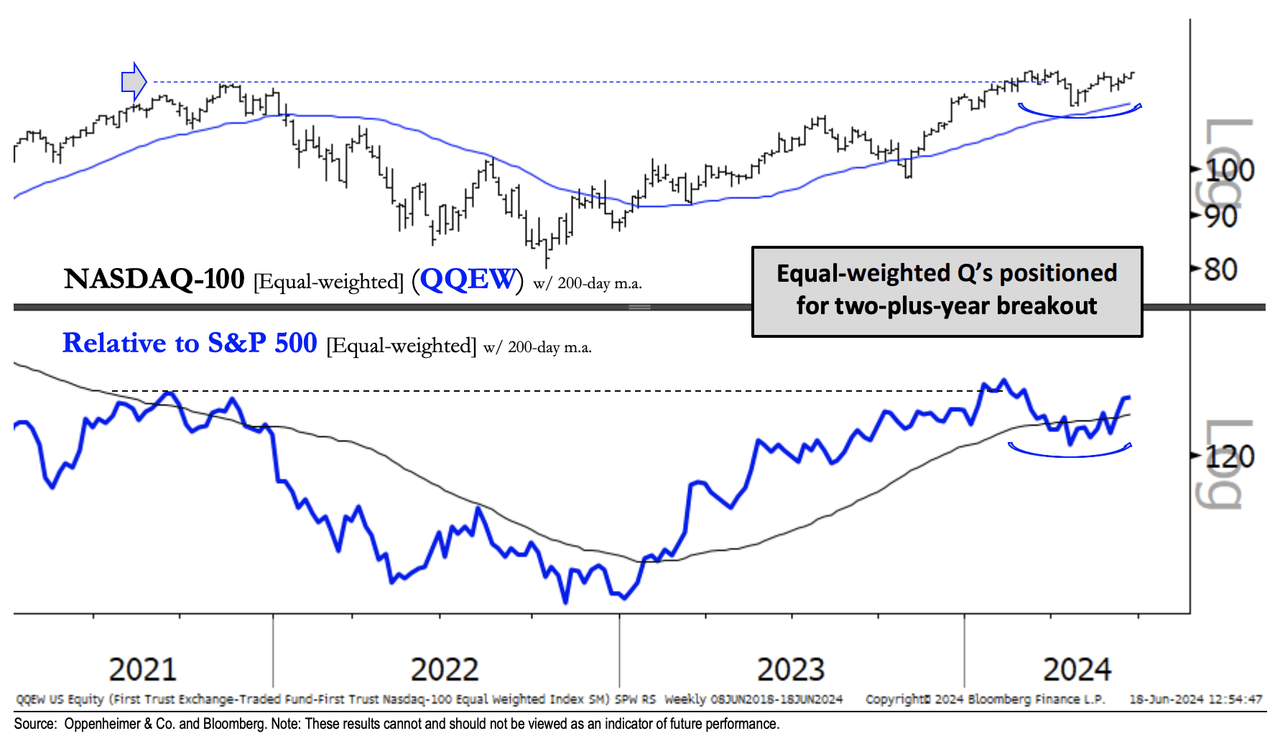

Was also likes the chart of the equal-weighted Nasdaq 100 (NASDAQ:QQEW).

“As a proxy for mid-cap growth, we see the equal-weighted NASDAQ-100 (QQEW) as a top rotation idea because we believe it strikes an attractive balance between secular growth leadership and intermediate-term rotation potential in lower capitalizations,” he said.

“The index rallied into its November 2021 peak in March and has since consolidated around this key resistance point. We believe this consolidation has allowed excesses to recede ahead of what we expect to be a multi-year breakout in trend.”

“Similar to our view on S&P Equal Weight, Russell 2000, Russell Value (IWD), and S&P High Beta (SPHB), we see this as untapped firepower for the next leg of the bull cycle,” he said.