sergeyryzhov

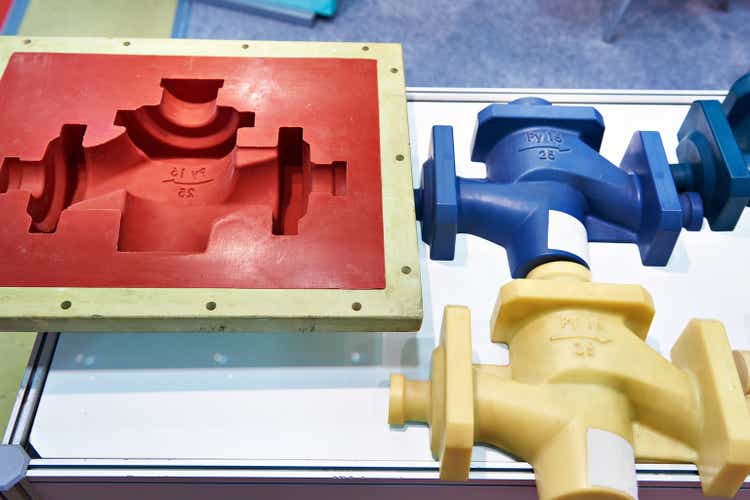

Hillenbrand (NYSE:HI) on Tuesday was rate Overweight in new research coverage by analysts at KeyBanc Capital Markets. They said the maker of industrial parts is poised to boost its profit with higher margins for its molding technology solutions business.

Shares of Hillenbrand (HI) rose 6.4% by 1:35 p.m. in New York trading Wednesday.

“While current cyclical dynamics remain choppy, we are starting to see signs of leading indicators coming off trough levels, which should begin to show through on the MTS business and its implied fiscal second-half 2024 ramp,” Jeffrey Hammond, analyst at KeyBanc, said in a July 9 report.

Management of Hillenbrand (HI) has sought to improve results by remaking its portfolio of operating units. Last year, the company completed the sale of its faltering casket-making business for $761 million.

“Hillenbrand (HI) shares are discounting the significant transformation the company has made over the last two years, and despite near-term cyclical concerns, we see a path for Hillenbrand (HI) shares to re-rate higher,” according to KeyBanc’s analysis.

KeyBanc set a price target on Hillenbrand’s (HI) stock of $50 a share, based on an estimated enterprise value that’s 10.2 times earnings before interest, taxes, depreciation and amortization and price-to-earnings ratio of 14.1 times.