aerogondo

The Industrial Select Sector SPDR Fund ETF (XLI) jumped +2.44% for the week ended July 12, while, the SPDR S&P 500 Trust ETF (SPY) rose +0.96%.

Joby Aviation took the top spot among the gainers, while airline-related stocks were among the decliners.

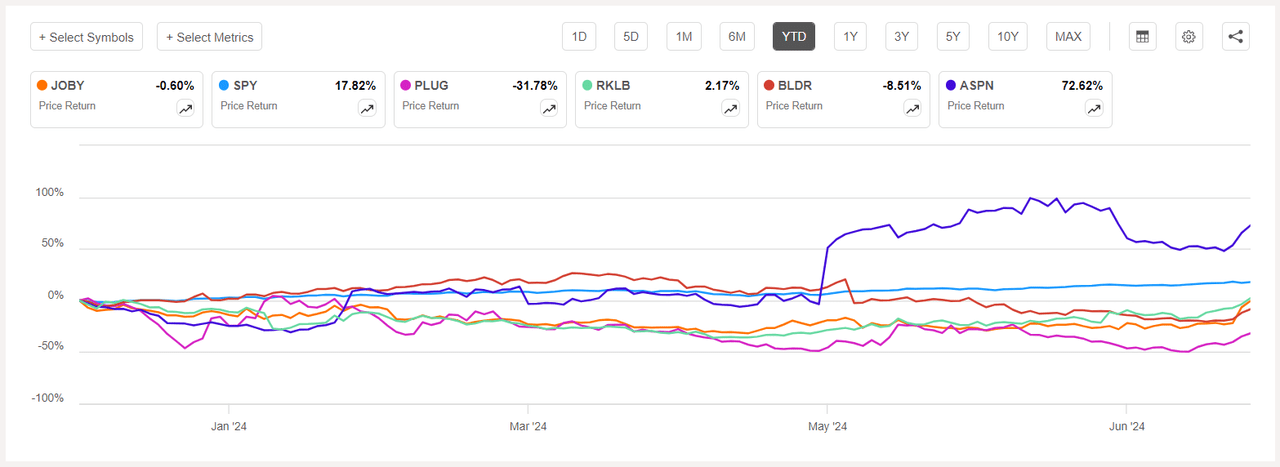

Industrials was among the 10 of the 11 S&P 500 sectors which ended the week in the green. Year-to-date, or YTD, XLI has risen +8.94%, while SPY has surged +17.82%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +14% each this week. YTD, only 2 out of these 5 stocks are in the green.

Joby Aviation (NYSE:JOBY) +28.10%. The stock soared +19.65% on Thursday after the company said it successfully flew a first-of-its-kind hydrogen-electric air taxi 523 miles, with water as the only by-product. YTD, -0.60%.

JOBY has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of B+ for Profitability and D+ for Growth. The average Wall Street Analysts’ Rating concurs and has a Hold rating too, wherein 3 out of 7 analysts tag the stock as such.

Plug Power (PLUG) +18.53%. Shares of the company, which develops hydrogen and fuel cell product solutions, were among solar and alternative energy stocks that rose on Thursday (+8.92%) boosted by cooler than expected inflation data that raised hopes the Federal Reserve will start lowering interest rates sooner rather than later. YTD, -31.78%.

The SA Quant Rating on PLUG is Sell with a score of D- for Momentum and B for Valuation. The average Wall Street Analysts’ Rating differs and has a Hold rating, wherein 18 out of 29 analysts see the stock as such.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Rocket Lab USA (RKLB) +15.78%. The space company’s stock rose throughout the week. YTD, +2.17%. The SA Quant Rating on RKLB is Hold with a score of B for Growth and B+ for Momentum. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 7 out of 12 analysts tag the stock as Strong Buy.

Builders FirstSource (BLDR) +15.18%. Stocks of makers and distributors of building materials also climbed on Thursday amid the soft inflation report. The Irving, Texas-based company’s stock rose +7.44% on Thursday. YTD, -8.51%. The SA Quant Rating on BLDR is Hold, which is in contrast to the average Wall Street Analysts’ Rating of Buy.

Aspen Aerogels (ASPN) +14.94%. The aerogel insulation products maker’s stock also rose on Thursday (+7.80%). YTD, +72.62%. The SA Quant Rating on ASPN is Hold, which differs from the average Wall Street Analysts’ Rating of Strong Buy.

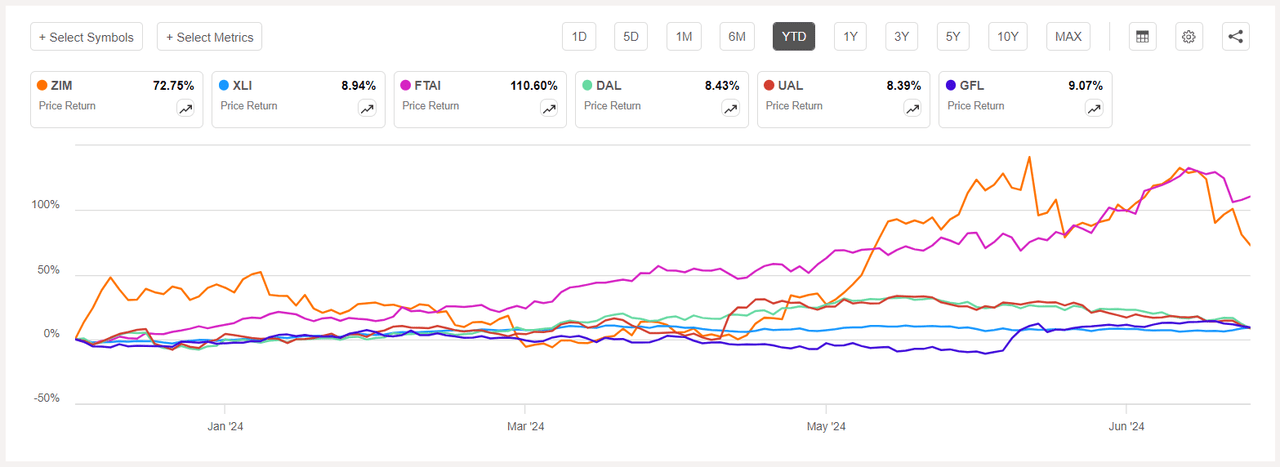

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -4% each. YTD, all these 5 stocks are in the green.

ZIM Integrated Shipping Services (NYSE:ZIM) -22.89%. The shipping company’s stock declined the most on Thursday (-9.88%). YTD, +72.75%. The SA Quant Rating on ZIM is Hold, with a factor grade of D for Profitability and A+ for Momentum. The average Wall Street Analysts’ Rating agrees and has a Hold rating as well.

FTAI Aviation (FTAI) -7.56%. The aircraft leasing and engine maintenance company’s stock fell -8.23% on Wednesday after Wolfe Research downgraded the shares to Peer Perform from Outperform. YTD, the stock has surged +110.60%

The SA Quant Rating on FTAI is Hold, with a score of A- for Growth and F for Valuation. The average Wall Street Analysts’ Rating disagrees and has a Buy rating, wherein 6 out of 12 analysts view the stock as Strong Buy.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Delta Air Lines (DAL) -5.22%. Shares of the Atlanta-based company dipped -3.99% on Thursday after second quarter results missed estimates. Delta also led the airline sector lower after warning of lower fare discounting. YTD, +8.43%.

The SA Quant Rating on DAL is Buy, with a factor grade of A+ for Profitability and B- for Growth. The average Wall Street Analysts’ Rating is also positive and has a Strong Buy rating, wherein 15 out of 21 analysts see the stock as such.

United Airlines (UAL) -4.85%. The Chicago-based company’s stock dipped the most on Thursday (-3.20%). Earlier in the week, a wheel fell off a Boeing 757-200 operated by United Airlines during takeoff from Los Angeles. Separately, JetBlue urged the U.S. Department of Transportation to disqualify UAL from securing one of five new round-trip flights from Washington Reagan National Airport. YTD, +8.39%.

The SA Quant Rating on UAL is Strong Buy, while the average Wall Street Analysts’ Rating is Buy.

GFL Environmental (GFL) -4.27%. Shares of the waste-management company dipped -1.63% on Tuesday after BMO Capital Markets downgraded the stock to Market Perform from Outperform. YTD, +9.07%. The SA Quant Rating on GFL is Hold, while the average Wall Street Analysts’ Rating is Buy.