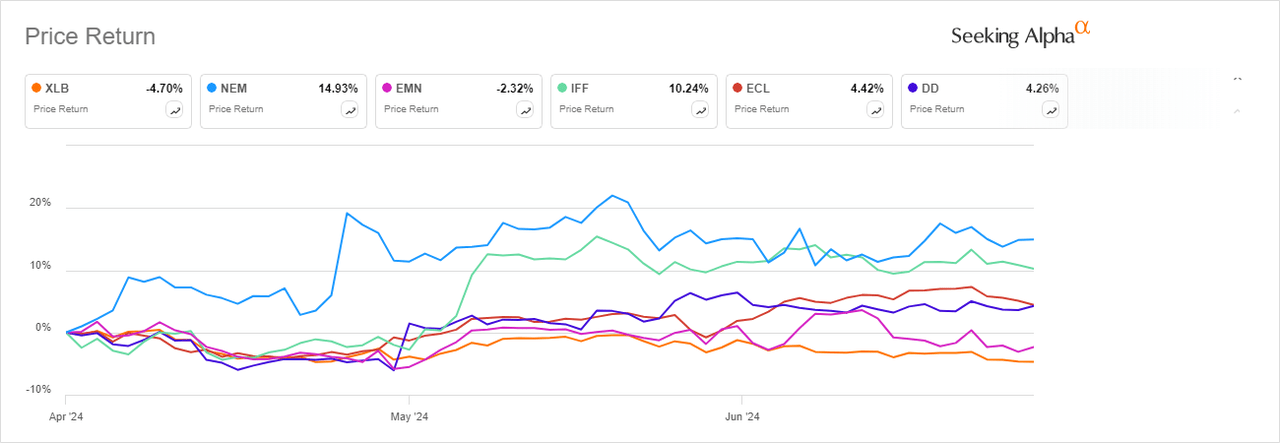

With the second-quarter earnings season around the corner, let’s take a closer look at the materials sector, which shed 4.7% in the April-June period, underperforming the broader stock market.

That compares to a 2.9% growth in the overall materials sector in the same period a year ago.

According to Seeking Alpha’s Quant Rating system, the S&P 500 Materials sector, which includes some of the big names such as Linde (LIN), Sherwin-Williams (SHW), Freeport-McMoRan (FCX), Air Products and Chemicals (APD), and Newmont (NEM), has an average health score of 2.74, and gets a ‘Hold’ rating.

The Quant Rating system assigns grades according to quantitative measures, like valuation, earnings growth, and recent stock performance, with the highest possible score of 5.

Looking into individual companies in the sector, Newmont (NEM), Eastman Chemical (EMN), International Flavors & Fragrances (IFF), Ecolab (ECL) and DuPont de Nemours (DD) top the quant rating chart.

Top gold miner Newmont (NEM) is the only company with a “Strong Buy” rating and a score of 4.74, faring well in growth, revisions, and momentum. The U.S.-based gold producer, however, did not fare well in profitability.

Eastman Chemical (EMN) ranked second in SA Quant Ratings, with a score of 3.81 out of 5. The stock has a B grade for profitability and valuation, and a B- for momentum and revisions.

Fertilizer maker The Mosaic Company (MOS) and lithium producer Albemarle (ALB) are the only two companies in the pack with a ‘Sell’ rating, with each earning a Quant score of 2.14 and 1.55, respectively.

Analyst comments

Seeking Alpha author Robert Wilson says, the Materials Select Sector SPDR Fund (NYSEARCA:XLB) has multiple buy signals, including the growth potential for several top chemical and mining industry holdings. These signals include increasing demands for green hydrogen, copper, and clean drinking water.

“XLB contains companies that are uniquely postured to fulfill these in-demand resources through their current capabilities and investment. Finally, while the fund has limited diversification, XLB has a competitive expense ratio and noteworthy dividend yield,” he added.

Furthermore, hedge funds bought commodity-sensitive energy and materials stocks at the fastest pace in five months, driven by long buys, Goldman Sachs said recently.

“After being net sold in 6 prior straight weeks, Materials (XLB) was net bought for the 3rd straight week,” they added. “On a subsector level, net buying in Containers & Packaging and Metals & Mining outweighed modest net selling in Paper & Forest Products and Chemicals.”

However, Citi analysts put Materials under “underweight sectors” in its latest S&P target points, along with how they weight each of the 11 S&P sectors.