Torsten Asmus

JPMorgan’s global markets strategy team noted that the short interest on the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) and the Invesco QQQ Trust ETF (NASDAQ:QQQ) has fallen to record lows, but cautioned that a reversal in that decline could impact U.S. stocks.

The SPY tracks Wall Street’s benchmark S&P 500 (SP500) index, while the QQQ tracks the tech-focused Nasdaq 100 (NDX). Both exchange-traded funds (ETFs) are hugely popular with investors, with the former being the oldest in the U.S. and the latter launching in 1999.

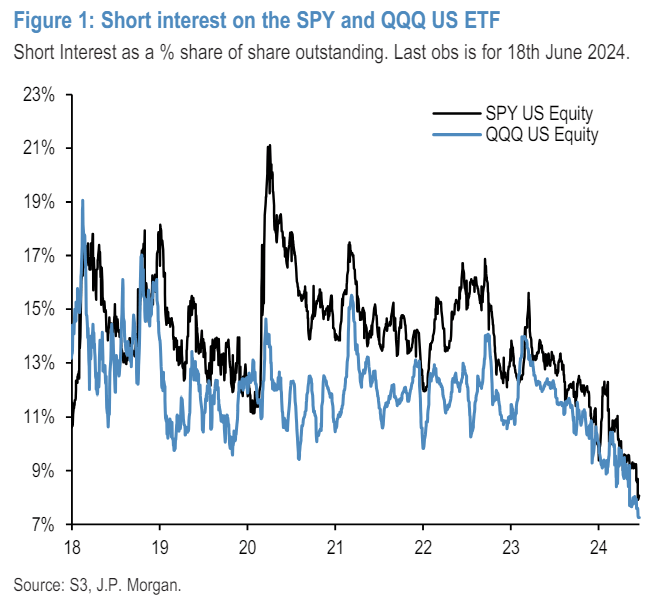

According to JPMorgan, a decline in the short interest on these two biggest equity ETFs since Q2 2023 has been a key support for the U.S. stock market. See below a chart highlighting the short interest information since 2018:

As per data provided to Seeking Alpha by S3 Partners, the short interest as a percentage of float on the QQQ was 16.61% in 2018. That slipped to 13.22% for 2023. Meanwhile, the short interest as a percentage of float on the SPY was 17.67% in 2018. That retreated to 14.35% in 2023.

As a comparison, in that same time period from 2018 to 2023, the QQQ has soared 163.05% and the SPY has jumped 78.11%.

“With SPY and QQQ representing major vehicles by investors for placing positions on U.S. equities at index level, their declining short interest has provided a steady flow support to U.S. equity indices as short positions were gradually covered,” JPMorgan’s Nikolaos Panigirtzoglou said in a research note on Thursday.

“In other words, the declining short interest over the past year in these two major ETFs has become the equivalent of an implicit short vol trade. And given how low their short interest is at the moment, this implicit short vol trade looks rather extended by historical standards posing a vulnerability to U.S. equities in a scenario were negative news start reversing the past year’s decline in short interest,” Panigirtzoglou added.

The analyst and his global markets strategy team estimates quarter-end rebalancing flow of around $50B out of equities.