greenbutterfly/iStock via Getty Images

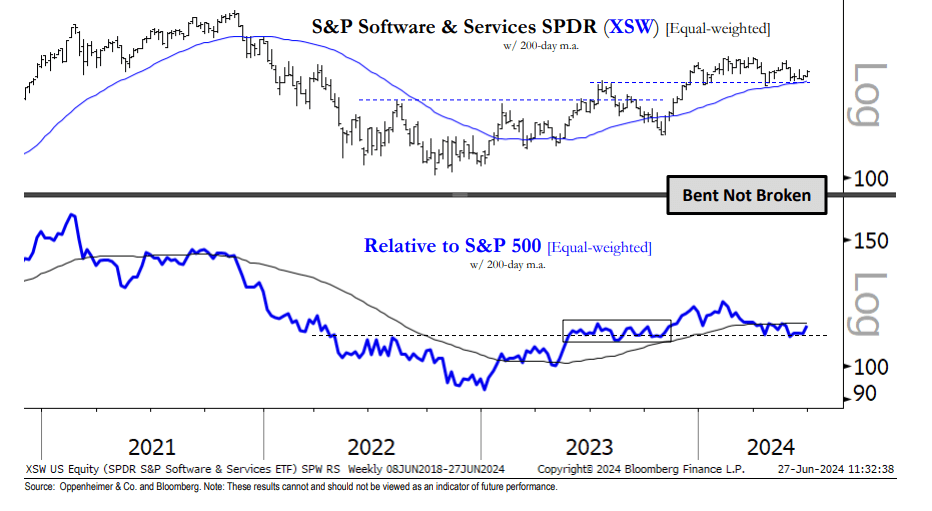

The software sector has had a falling MO score since early June, but Oppenheimer analysts see relative strength through the correction.

An MO score is based on a stock’s six-, nine-, and 12-month risk-adjusted return with the last month removed.

According to an Oppenheimer Technical Analysis, these are the grounds for its defense:

The S&P software and services ETF (NYSEARCA:XSW) is trading above its 200-day average at $142.

The market is in a bull cycle, and it provides top-down support.

Lastly, the larger relative breakout in the top-down support ratio is intact.

“Our tactical preference has been toward Software stocks that have shown relative strength through the industry’s correction,” said Analyst Ari H. Wald.

The following software stocks are rated “outperform” by Oppenheimer analysts:

- Altair Engineering, Inc. (ALTR) – Buy-rated

- Crowdstrike Holdings, Inc. (CRWD) – Buy-rated

- Guidewire Software, Inc. (GWRE): Buy-rated

- HubSpot, Inc. (HUBS) – Buy-rated