honglouwawa

Most responders to Seeking Alpha’s July Sentiment Survey believe Wall Street’s benchmark S&P 500 (SP500) index will end this year at around 5,850 points, representing a nearly 5% upside from its current level.

The SA Sentiment Survey takes the temperature of what investors are thinking about in terms of market themes, the economy and other investment topics. The July survey drew 997 responses in total.

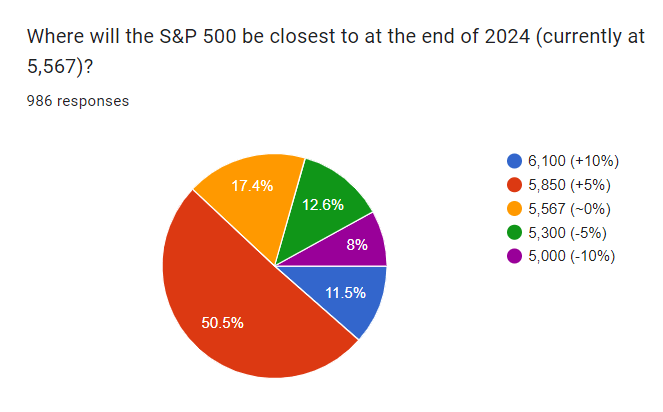

The survey asked investors “where will the S&P 500 be closest to at the end of 2024?” That question saw 986 responses, of which 498 or 50.5% answered 5,850 points – a level that would mean a rise of 4.8% from the benchmark gauge’s last close at 5,584.46 points.

The second-most chosen answer was 5,567 points by 172 respondents, or 17.4% of the total. Next, 124 or 12.6% said 5,300.

Only 79 respondents, or 8%, think the S&P 500 (SP500) will slip to 5,000 points. On the other hand, 113 respondents, or 11.5%, believe the index can reach as high as 6,100, which would imply a 9.2% climb from its last close.

See below for a visual representation of the answers:

The S&P (SP500) has surged so far in 2024, driven by a combination of factors including a massive rally in technology stocks on the back of the artificial intelligence craze and a growing expectation that the Federal Reserve will deliver interest rate cuts.

The benchmark gauge clocked a stellar first six months of the year with an advance of more than 14%. The index posted 32 all-time intraday highs in the first half, making it the sixth-highest number for any H1 since 1928.

Here are some exchange-traded funds tied to the S&P 500 (SP500) that investors can track: (SPY), (VOO), (IVV), (RSP), (SSO), (UPRO), (SH), (SDS), and (SPXU).