Spencer Platt/Getty Images News

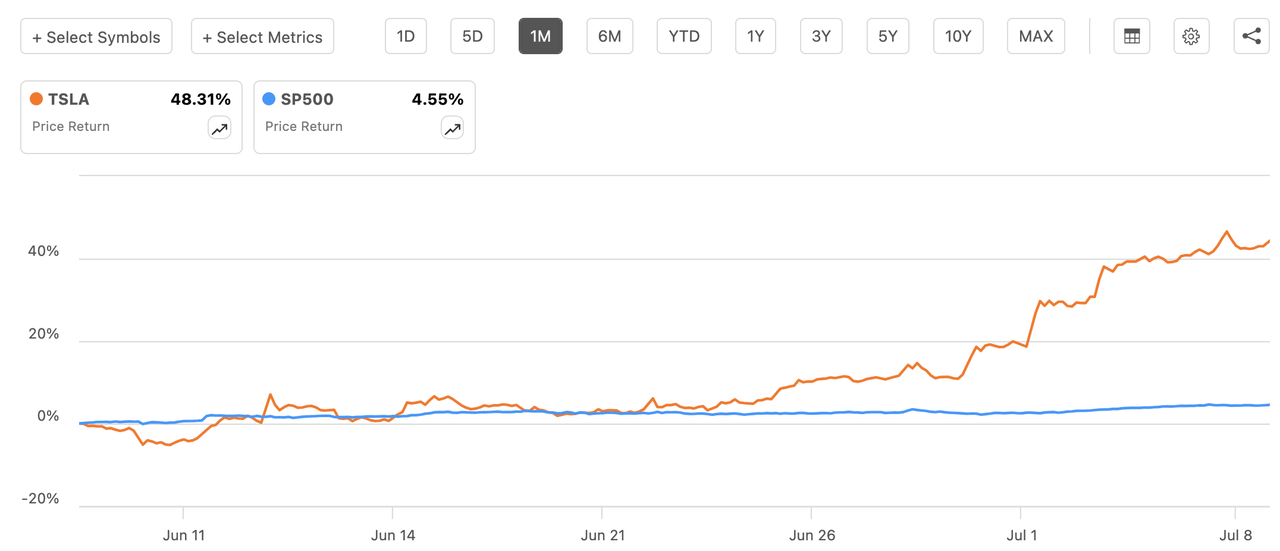

Tesla’s (TSLA) been in vogue on the Interactive Brokers (IBKR) trading platform, with a recent surge in the electric vehicle maker’s stock price drawing attention away from AI chipmaker Nvidia (NVDA).

Shares of Tesla (TSLA) on Tuesday cemented their 10th consecutive win, and the “straight up price action” in part prompted legendary bond market fund manager Bill Gross to say on X that Tesla was “acting like a meme stock.”

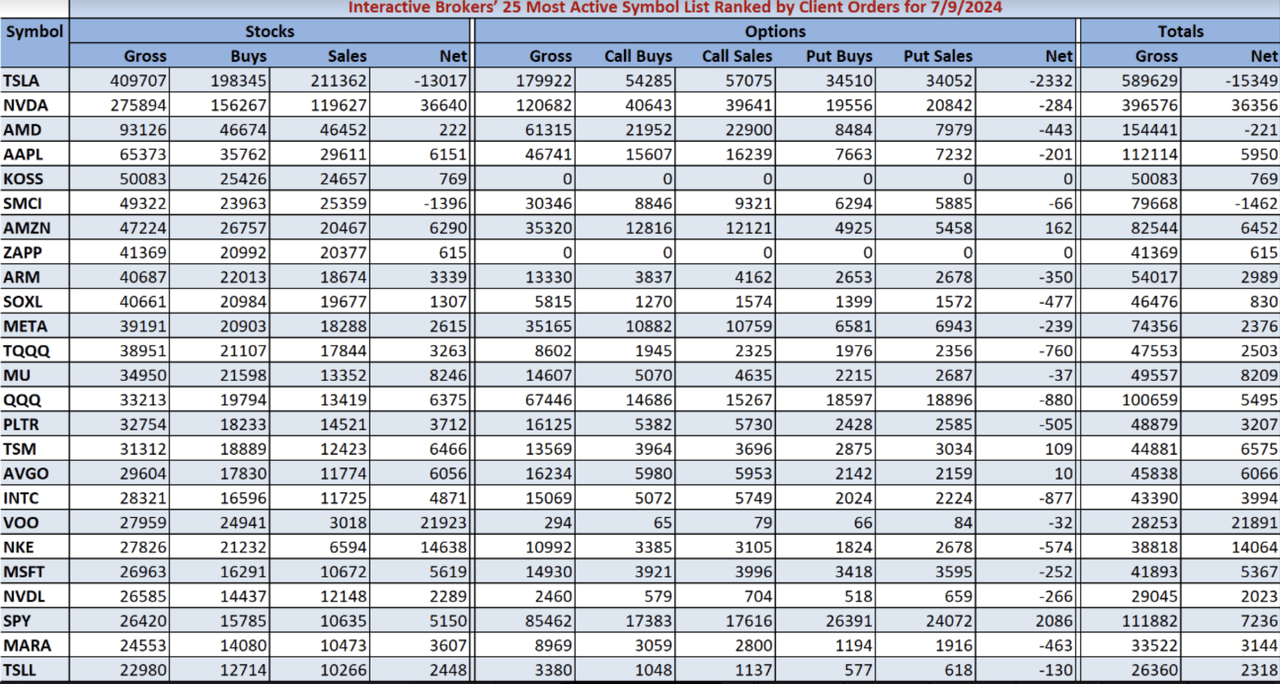

With Tesla (TSLA) logging gross trades of 589.6K across its stocks and options, the carmaker topped IBKR’s list of the 25 most-active symbols on its platform over the past five sessions.

“Look who’s back,” IBKR’s Chief Strategist Steve Sosnick said Tuesday. “It’s (TSLA) supplanting (NVDA) at the top of the table in both stock and options activity,” he said.

Tesla’s (TSLA) price has climbed to +$262 from +$187 over the past 10 sessions, fed partially by a better-than-expected Q2 deliveries report and growing expectations for the company’s Robotaxi event in August.

“(TSLA) has been on a tear for the past few days while (NVDA) has been relatively stagnant,” Sosnick said. “You never forget your first love, I suppose – even if the net activity was to the sell side,” he said, referring to -15.3K total net sales of Tesla (TSLA) stock and options.

He also noted a run-up in Zapp Electric Vehicles Group (ZAPP), which snagged spot #7 on IBKR’s weekly list. Zapp’s stock price leapt to $10 from $2 in the days covered by IBKR’s report. It surged 341% on Tuesday to $17.95.

Meanwhile, well-established meme stocks GameStop (GME) and Chewy (CHWY) dropped off IBKR’s most-active list.

See below for the full data on the IBKR 25 most-active list: