vovashevchuk

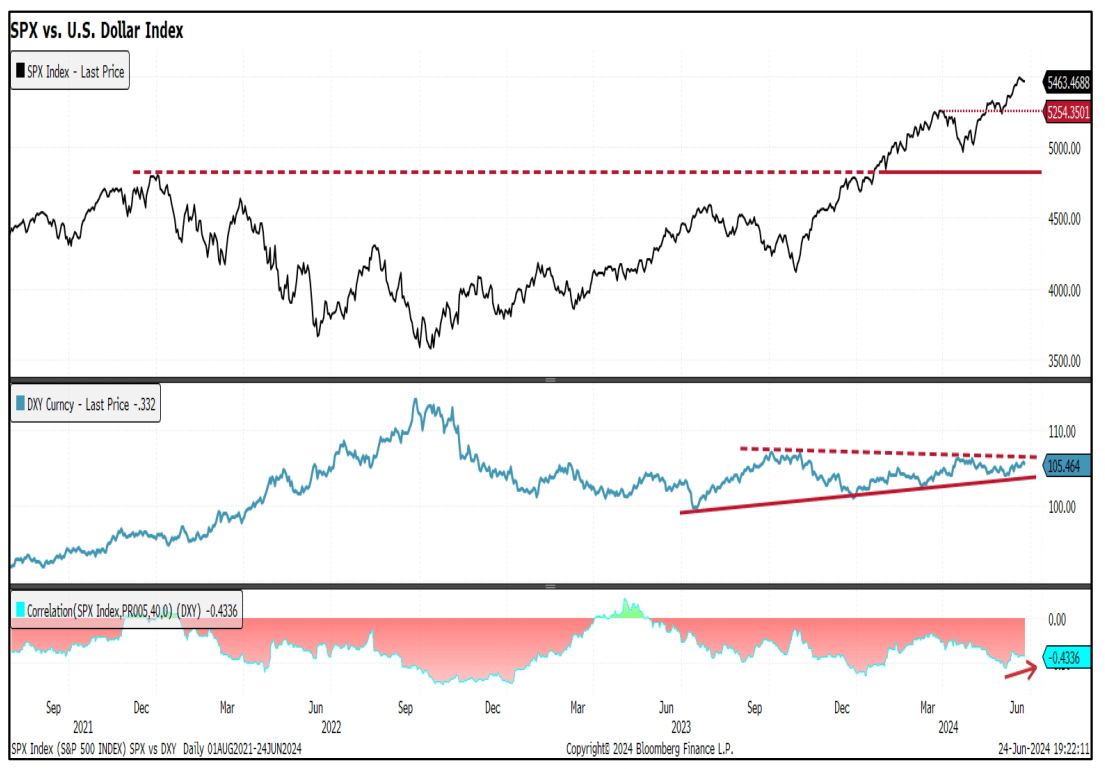

The negative correlation between the U.S. dollar (DXY) and the S&P 500 (SP500) is expected to continue for several months.

According to a technical research report by Piper Sandler, the negative correlation between the U.S. dollar (DXY) and the S&P 500 (SP500) has lessened a little during June (down -0.43%), but it should persist for several months, after it has lasted for almost a year.

“The Federal Reserve claimed it has finished hiking rates for this cycle, and alluded to the possibility of a rate cut later this year if the economic data suggests doing so,” wrote Analyst Craig W. Johnson in the report.