Torsten Asmus/iStock via Getty Images

The S&P 500 (NYSEARCA:SPY) is “the perfectly constructed index,” where you need either the best top five names going higher or the other 495 names higher.

“They just can’t both be down a lot at the same time,” Goldman Sachs Analyst Scott Rubner wrote in a Flow of Funds note.

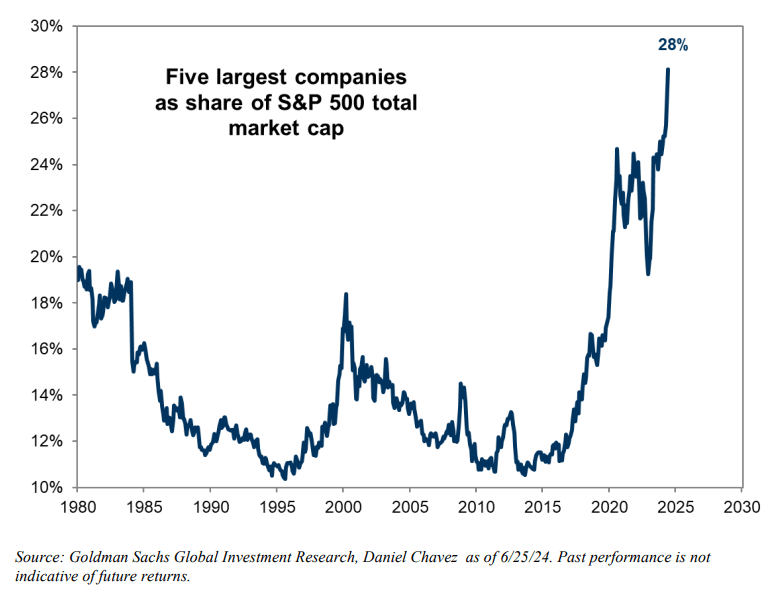

If an investor allocates $1 into the S&P 500 (SPY), $0.28 go into the top five stocks — Microsoft (MSFT), Nvidia (NVDA), Apple (AAPL), Amazon (AMZN), and Meta (META).

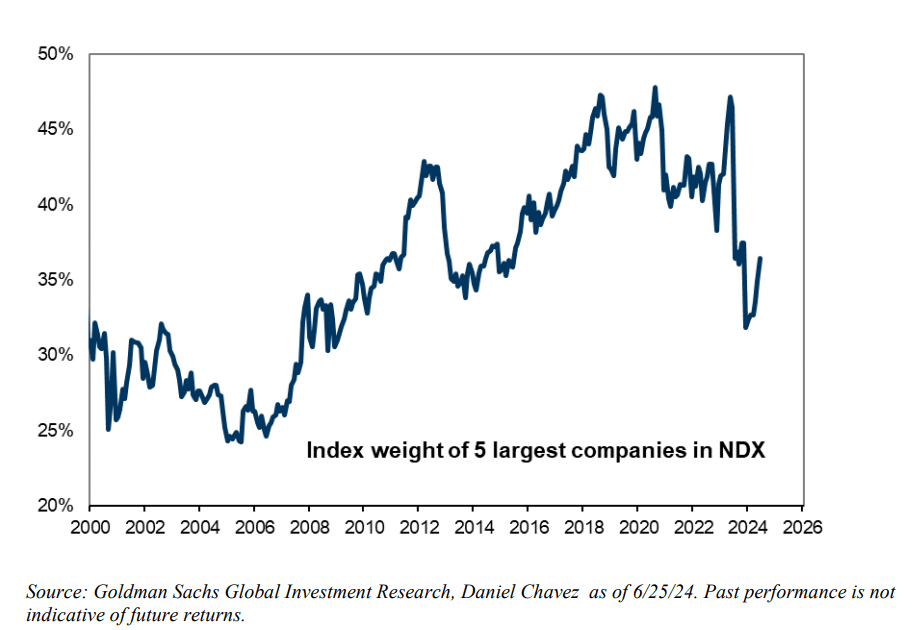

Similarly, if an investor allocates $1 into the Nasdaq (QQQ), (QQQM), $0.36 goes into the top five stocks.

When it comes to the semiconductor ETF (SMH), if an investor allocates $1 into it, $0.20 goes into Nvidia (NVDA). Also, if an investor allocates $1 into the Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL), $0.20 goes into Nvidia (NVDA), 3x.

“Levered single name ETF – such as the GraniteShares 2x Long NVDA Daily ETF – with $4B in assets under management, has traded $10B worth of shares in the past five days, “higher than multiple blue chip companies.”

This ETF saw a record inflow last week, and it is up 364.13% year-to-date.