da-kuk/E+ via Getty Images

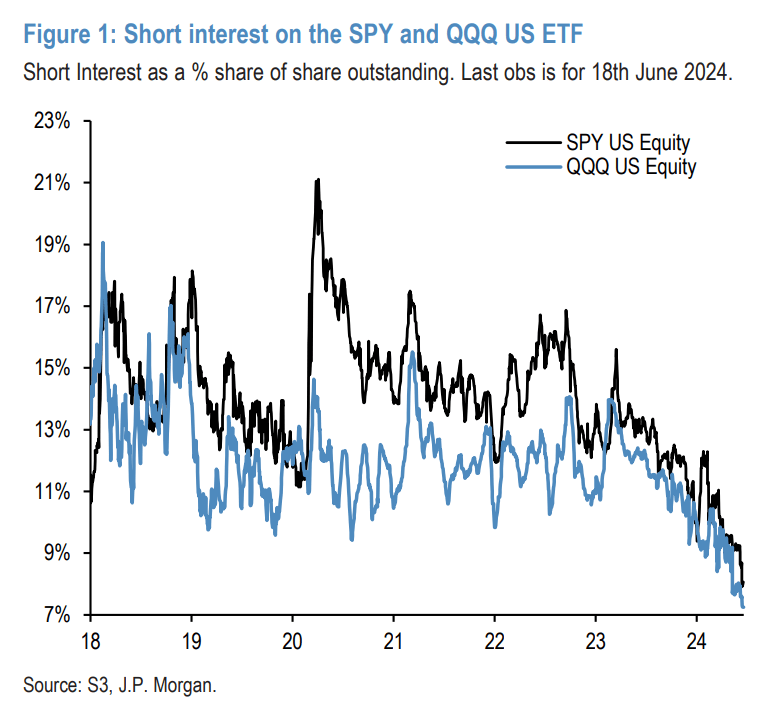

Short interest in the S&P 500 Trust ETF (NYSEARCA:SPY) and the Nasdaq 100 (NASDAQ:QQQM) has reached a record low.

There has been a steady decline in the short interest on the two biggest ETFs since the second quarter of 2023, according to a J.P. Morgan Global Markets Strategy report.

Analyst Nikolaos Panigirtzoglou wrote that this declining short interest over the past year has become the equivalent of an implicit short volume trade, and it looks “rather extended by historical standards, posing a vulnerability to U.S. equities in a scenario were negative news start reversing the past year’s decline in short interest.”

However, when it comes to short interest over the past year for individual stocks — for either the mega-caps or the broader S&P 500 (SP500), (SPY), (VOO), (IVV), (SPXU) — there has been no significant increase.

The declining short in the S&P 500 (SPY) and the Nasdaq 100 (QQQM) ETFs “does not only reflect a net increase in U.S. equity exposure by hedge funds over the past year, but also a shrinkage of short sellers.”

Panigirtzoglou attributed this shrinkage to several factors:

It is now more difficult to sustain short positions given the “steeply rising” U.S. equity market.

Regulations and transparency within shorting has made short selling more costly.

There is more active engagement by U.S. retail investors in trading after the pandemic.

The “meme stock” frenzy of January 2021 has also deterred short sellers.

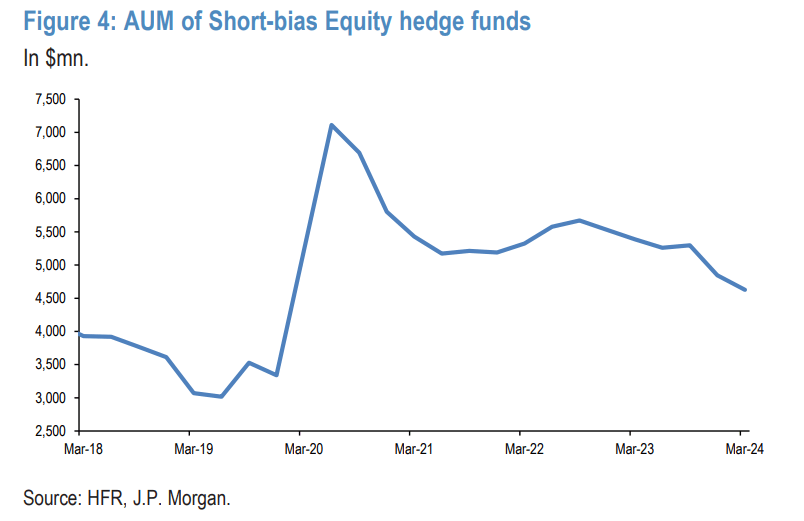

In addition, the assets under management of short-bias hedge funds have been declining in recent years. This signals a heightened vulnerability to negative news, said Panigirtzoglou.