phongphan5922

Roth MKM has spotted two exchange-traded funds – the iShares Biotechnology ETF (IBB) and the iShares Expanded Tech-Software Sector ETF (IGV) – that appear ripe for upside moves, while outpointing another fund at risk of heading lower.

The investment bank outlined its observations in a technical strategy note Sunday that also said market breadth remains a concern with the S&P 500 (SP500)(SPY)(VOO) heading into July, which tends to be the strongest month for stocks, averaging 2.3%, according to 20 years of data.

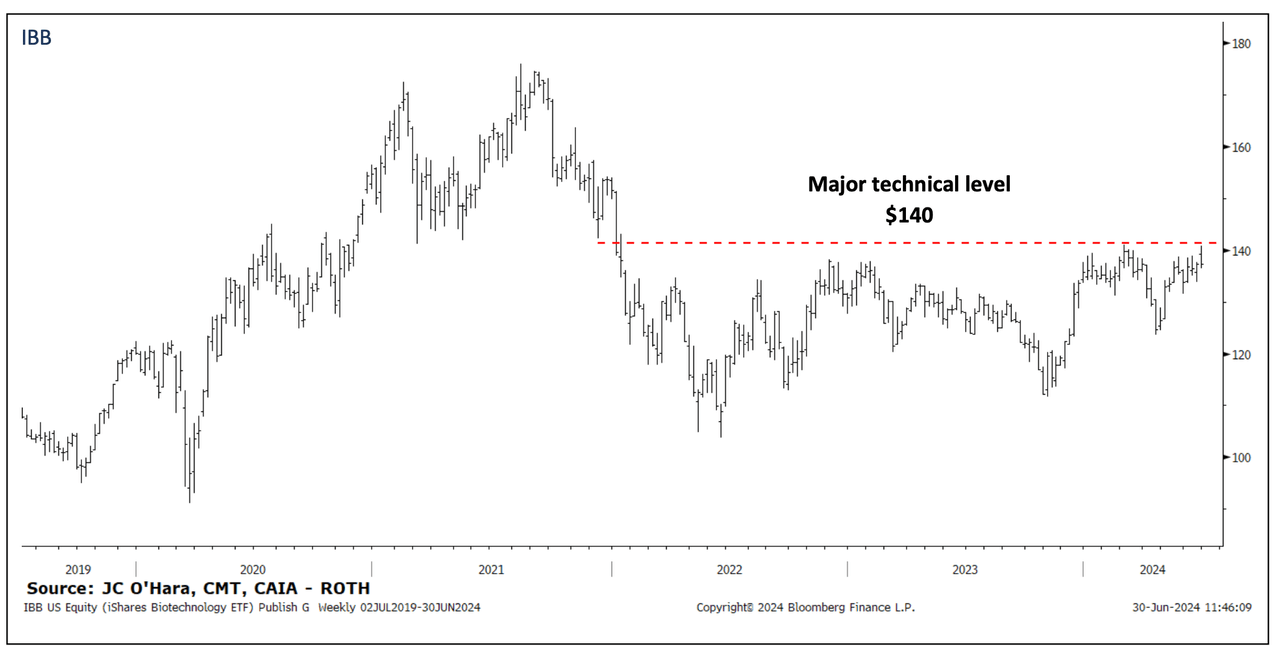

In the note, O’Hara said its equal weighted sector rankings show Health Care (XLV) is an underweight. “[Yet] there could be some potential upside momentum if biotech can break out,” he said.

The price of the iShares Biotechnology ETF (IBB) was sitting just under a major chart resistance at $140. “A break above that line will suggest a move to $160. This is not a high conviction call due to the lack of real breadth under the surface,” he said. The ETF traded above $137 on Monday.

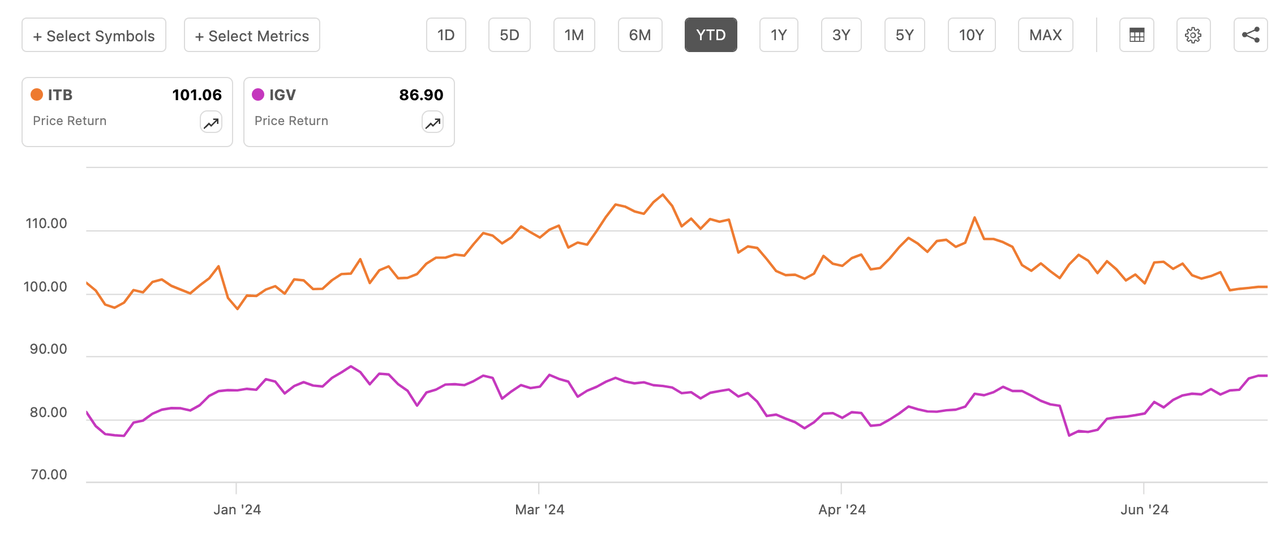

Looking at software within the technology sector, Roth MKM charted a longer-term look at The iShares Expanded Tech-Software Sector ETF (IGV), and a break above $90 will be “powerful for upside momentum,” O’Hara said. “If the IGV can break above $90, the short-term target is $100/$105.” The fund was trading around $87 on Monday.

Meanwhile, caution is warranted on the iShares U.S. Home Construction ETF (ITB) with the price starting to form a pattern that resembles a topping formation. “The ITB remains above its rising 200 DMA but a break under $100, in our opinion, will have downside risk to ~$90.” The ETF was above $98 during Monday’s session.