Vertigo3d

We are not at the start of a great rotation, but details from the leading to the 2000 tech bubble burst, may shine a light on what’s happening today, said Deutsche Bank Research’s Jim Reid.

Yesterday, 396 stocks of the S&P 500 (SP500) were up, but the overall S&P index was down 0.88% — “the biggest gap between the overall S&P 500 (SP500) and the equal-weighted S&P 500’s (RSP) performance since the Pfizer (PFE) vaccine announcement in November 2020,” wrote Reid on a Chart of the Day note.

This was caused by the fall for the Magnificent Seven stocks’ — Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Alphabet (GOOGL), Amazon (AMZN), Meta (META) and Tesla (TSLA) — performance, down 4.26%.

The S&P 500 equal weight (RSP) was up 1.17% and the Russell 2000 (IWM) was up 3.57%, its best day since last November.

“This the start of a great rotation?” he said. “Only a very brave, or perhaps foolish, person would have any confidence in such a statement, but it did remind me a little of the trends of 2000 when the peak in tech marked a huge rotation way before the overall market saw its largest falls.”

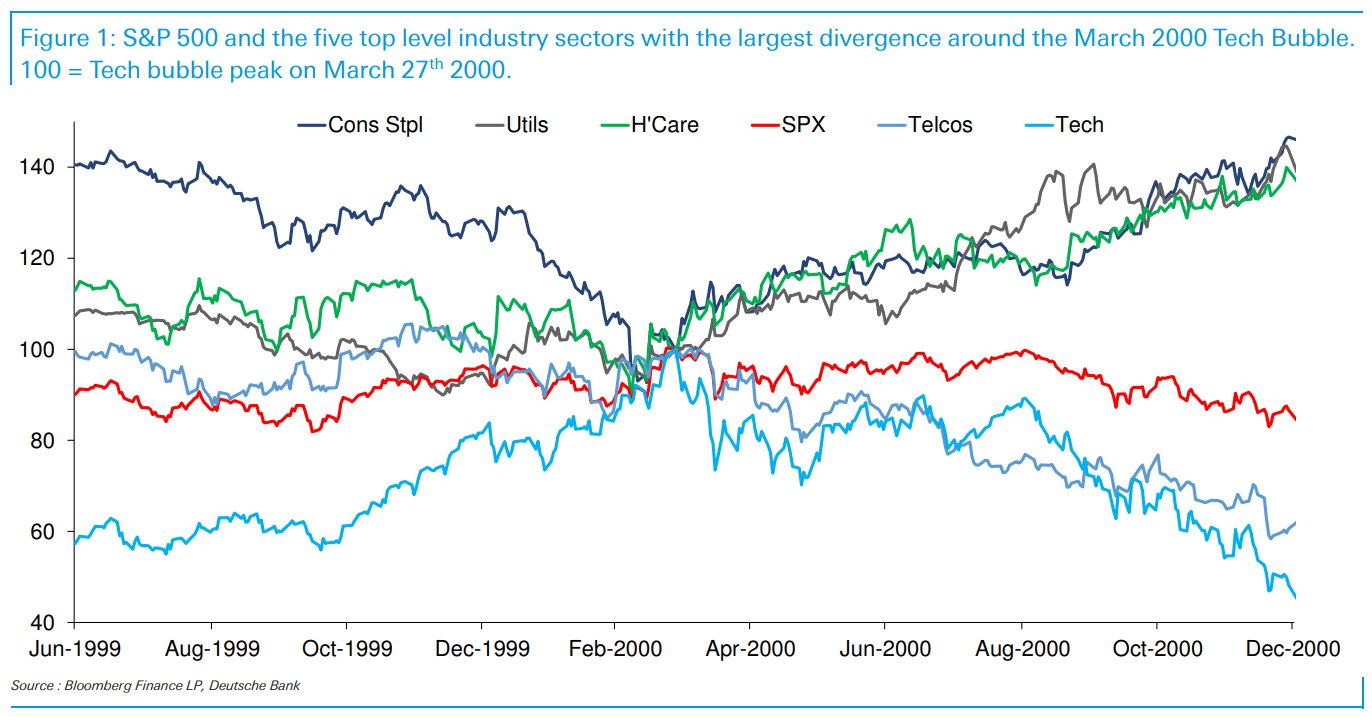

In the lead-up to the tech peak on March 2000, he said, defensive sectors — such as consumer staples (XLP), health care (XLV), and utilities (XLU) — were falling sharply, suggesting a rotation “out of seemingly steady ‘dull’ stocks into high octane ones.”

But when the tech bubble burst, money came back into them immediately, and by the end of the year, tech stocks (NYSEARCA:XLK) were up 35-45% higher than before the burst, Reid noted.

The S&P 500 (SP500) dipped 10% within three weeks of the burst of the bubble. By September, it was back around its highs, even with information tech (XLK) and telecoms (IYZ) down -10% and -25% respectively.

After this, those two sectors fell strongly (ultimately about -85% and -75%), but the three defensive sectors climbed just over 25% higher since March 2000.

“So, the ultimate rotation was a significant one!”

Below is a chart looking at the five sectors out of the top 10 of the S&P 500 (SP500) and their largest divergence around the bursting of the tech bubble. The indices are benchmarked to 100 at the peak.