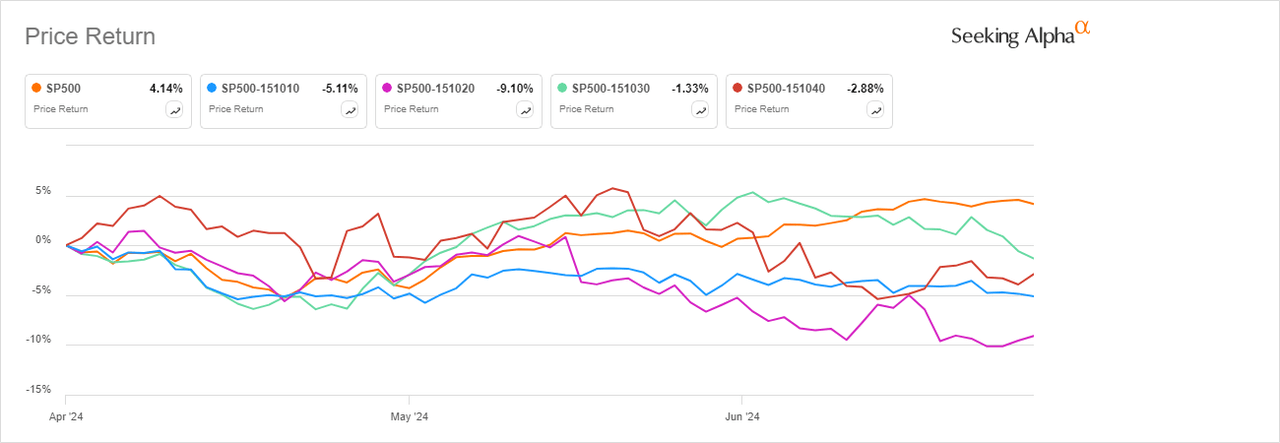

The Materials Select Sector SPDR Fund ETF (NYSEARCA:XLB), which tracks the S&P 500 materials sector, shed 4.7% in the second quarter of 2024, underperforming the broader S&P 500 index, which increased by 4.1% during the same period. The materials sector rose nearly 9% in the first quarter.

Newmont (NEM) saw the biggest growth in the S&P 500 materials index, rising about 17% in the April-June quarter. The miner was recently upgraded at UBS to ‘Buy’ with a $50 price target, as the brokerage remains constructive on gold prices, which is expected to drive consensus upward earnings revisions.

Albemarle (ALB) meanwhile saw the biggest decline in the pack in the past three months, falling about 27% owing to a not-so-bright outlook for lithium prices amid a supply glut, and as higher interest rates impact demand for electric vehicles.

However, even as the SPDR material-focused ETF (XLB) managed to gain just 3.3% through 2024 against the broad-based index ETF (SPY), almost 80% of the tickers in the sector ETF managed to peak in value over the last year. From the end of 2023 through June 20, 22 of the 28 stocks in the S&P 500 Material sector hit 52-week highs, while 5 stocks hit 52-week lows over the period of almost 6 months.

Among industries, containers & packaging (SP500-151030) ticked lower by 1.3%, construction materials (SP500-151020) fell the most, declining by over 9%, the chemicals industry (SP500-151010) shed about 5%, while metals and mining (SP500-151040) lost 2.9% in Q2.

Top movers in Q2

Gainers

- Newmont (NEM) +16.8%

- International Flavors & Fragrances (IFF) +10.7%

- Air Products and Chemicals (APD) +6.5%

- DuPont de Nemours (DD) +5%

- Freeport-McMoRan (FCX) +3.5%

Losers

- Albemarle (ALB) -27.5%

- Celanese (CE) -21.5%

- Nucor (NUE) -20.1%

- The Sherwin-Williams Company (SHW) -14.1%

- PPG Industries (PPG) -13.1%

What Wall Street Analysts Expect

Wells Fargo Investment Institute expects companies in the Industrials and Materials sectors to contribute to artificial intelligence-related infrastructure build-out, adding that the generative AI push will positively support these sectors even in a slower growth-based economy. Regarding the Materials sector, industry groups such as construction materials, copper, and steel should also benefit from the artificial intelligence push.

Oppenheimer Asset Management meanwhile spotlighted consumer discretionary, energy, materials, and information technology, and indicated that it believes that further market upside is possible as the major market averages rally near record highs.

What Quantitative Measures Say

XLB receives a Hold rating from the Seeking Alpha quant system with a score of 2.73. This comes in large part due to a D grade in the category of risk and a C+ for momentum. The stock, however, earns a B+ for dividends, an A+ for liquidity, and an A for Expenses.